As HR leaders, you have to navigate constantly shifting priorities, evolving work models, and of course, rising employee expectations.

Lifestyle benefits can help you achieve a level of balance with all of these pain points, but they’re a relatively new category within the realm of employee benefits.

Our recently released 2024 Lifestyle Benefits Benchmarking Report details all the different ways companies and employees are using their benefits to improve their lives and enhance productivity.

We asked 6 HR leaders to share their biggest takeaways after reading the report. Here’s what they said:

#1 Quarterly stipends result in higher utilization rates (75%)

From our work with customers who offer multiple stipend categories in a quarterly time frame, we've concluded that a quarterly period is long enough to allow employees to use thoughtfully, but not so long that they forget or wait until the last minute (like end of year in some cases) to take advantage.

Shelby Wolpa, Founder of Shelby Wolpa Consulting, told us this after learning about the sweet spot for utilization:

“I was especially surprised to learn that offering fewer categories on a quarterly basis results in happier employees and higher utilization. Post-finance companies often make costly mistakes in this realm, so having this information can help them make strategic investments effectively the first time around.

As an advisor to people leaders building remote teams at series A to C companies, I'm constantly on the lookout for cost-effective benefit solutions that foster a thriving remote culture and attract diverse talent. It's remarkable that a simple quarterly stipend can help HR achieve these outcomes.”

#2 Big budgets aren’t required for small businesses to win

Budget limitations don’t preclude businesses from succeeding with lifestyle benefits. Creative, personalized benefit options can be the key to helping you attract and retain employees.

Sabrina Greenwood-Briggs, CEO of Sabrina Louisa Consulting, which provides HR consulting to small businesses, commented on how empowering this realization is:

“One of the biggest misconceptions I think small business owners have is that they cannot afford to offer benefits, especially not a variety of benefits that all of their employees might value and/or utilize. This report clearly shows that employees across all of the companies on the platform have a wide variety of needs and wants. I think that fact can intimidate some small business owners into thinking they won't be able to have a solid benefits offering that their employees use and so they will often do nothing in this realm. What I think this report shows, though, is that with the right mix of offerings, you can make a lot of people inside your company happy with your benefits.”

At Compt, we’ve noticed that smaller budgets are able to garner engagement rates as high as 90%. Again, a larger budget does not necessarily equal better utilization–it all comes down to how your program is designed.

Greenwood-Briggs offered this additional context:

“My experience in the small business market is that their focus on benefits as a part of total compensation often comes from a place of wanting to offer their employees something that shows that they care about their employees' total wellbeing and their whole lives. Alongside this is often a lower salary base, industry and revenue dependent. They often believe their willingness to spend on benefits shows that they value their staff and what matters to them, above and beyond just a base salary.”

When working with us to design a stipend program, many of our customers express a desire to demonstrate appreciation that surpasses basic salary considerations. However, beyond the noble intention of caring for their employees, there exist additional benefits, like the potential cost savings as Greenwood-Briggs noted:

“Additionally, there is a bit of a gamble in place as not all employees will opt in or use these benefits and so even when a small company may budget for the expense, the reality is that they may not actually spend their entire budget. This can save them cash, but also buys them the upfront good will of being a company that offers an array of benefits to their employees. I have worked with a few small business owners where we pulled together creative ways they could support their employees with benefit options that matter to them and that will actually be utilized by their employees, which drives satisfaction and loyalty.”

#3 Professional development is table stakes; Broker relationships are key

Professional development came in as the fourth most popular stipend offering, which confirms that upskilling and growth remain crucial employee expectations.

Patrick Mercer, champion of upskilling as the Assistant Vice President & Wellness Director at Frost Insurance Agency agrees:

“I’m in full agreement that professional development is now table stakes for employers looking to help their workforce upskill and grow both personally and professionally! As industries undergo rapid transformation and new challenges emerge, prioritizing continuous learning ensures that employees remain equipped with the latest skills and knowledge needed to excel in their roles.”

Additionally, he was surprised to learn that brokers supporting the implementation of a learning and development benefit saw a 20% higher utilization rate.

“I’ve long understood the relationship consultants can play in helping bring L&D benefits to their employer groups, but never would’ve guessed those who implement alongside their broker partner average 20% higher utilization! This data underscores the importance of those relationships.”

At Compt, we work with benefit brokers and consultants to create customized solutions for their clients. Click here to learn more.

#4 Health & Wellness remains a crucial category

Our data shows that employees are spending the most money on health and wellness claims. Some of the most popular wellness purchases include gym memberships, fitness equipment, and massages.

Stacey Boschetto, Director of Human Resources at Mythic Therapeutics, explains how these benefits can play a crucial role in ultra-competitive industries like biotech:

“Being a small Private Company in the highly competitive Biotech Industry introduces several challenges in creating a culture that allows us to retain and attract top talent. This data shows how valuable investing in our employee's health & well-being is to achieving high engagement and a workplace where employees feel valued.”

Furthermore, Boschetto emphasizes the importance of tailoring wellness programs to individual preferences, stating,

“The diverse areas that employees spend their money on reinforces our decision to create a program that aligned with the spirit of what we believe a wellness program should be; we did not want to dictate what or where employees had to spend their money, but rather, give employees the freedom to decide what Health & Wellness means to them and their families.”

At Compt, we believe in treating employees like autonomous adults (see also: The Deparentification of HR) and empowering them to make their own decisions about how they use their benefits. This approach reflects a shift away from traditional HR practices of dictating employee choices, allowing individuals to leverage their benefits according to their unique needs and preferences.

#5 Personalization wins over big budgets or “popular” benefit offerings

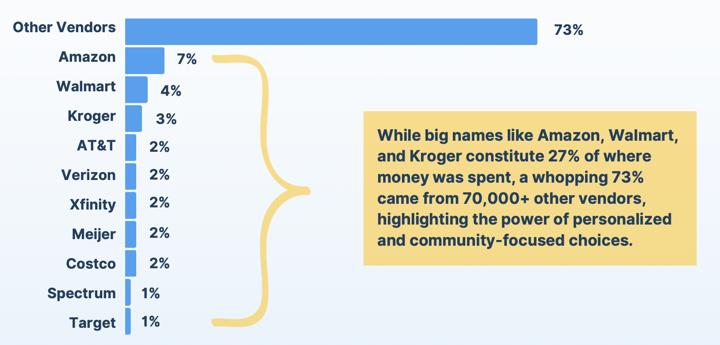

Claims were submitted for a whopping 70,000+ unique vendors across all categories. This level of flexibility is simply not possible with a vendor marketplace or card solution.

By focusing on solutions that align with the diverse needs of your workforce, you can make a significant positive impact. While health insurance and retirement plans are undoubtedly popular employee benefits, Lance Haun, Vice President at The Starr Conspiracy, explains how he evaluates the effectiveness of a benefit program:

“While some work leaders view benefits through the lens of popularity, I tend to view it through the lens of individual employee impact. Some of your most popular benefits programs probably don't move the needle the way you might think. For example, vision benefits are popular, low-cost benefits to offer employees and most enroll, while tuition reimbursement is comparatively less popular. Yet, when you ask an employee who finished a degree or learned new skills because of tuition reimbursement which benefit is more meaningful, you start to figure out that it's not a popularity contest.”

Haun also calls out the constant shift in the needs of employees given and how lifestyle benefits can evolve in lockstep:

"Personalization and individual impact are what make lifestyle benefits so powerful. When you give people choices, this report shows you don't need to have a huge budget to make a real impact and improve loyalty, trust, and engagement. While it was fascinating to see how spending preferences have changed and shifted, the point is that there will always be shifts in what employees want and need. Lifestyle benefits give employers the ability to be responsive to all kinds of diverse needs — without having to administer hundreds (or thousands) of individual benefits.”

#6 All-inclusive stipends support diverse employee preferences

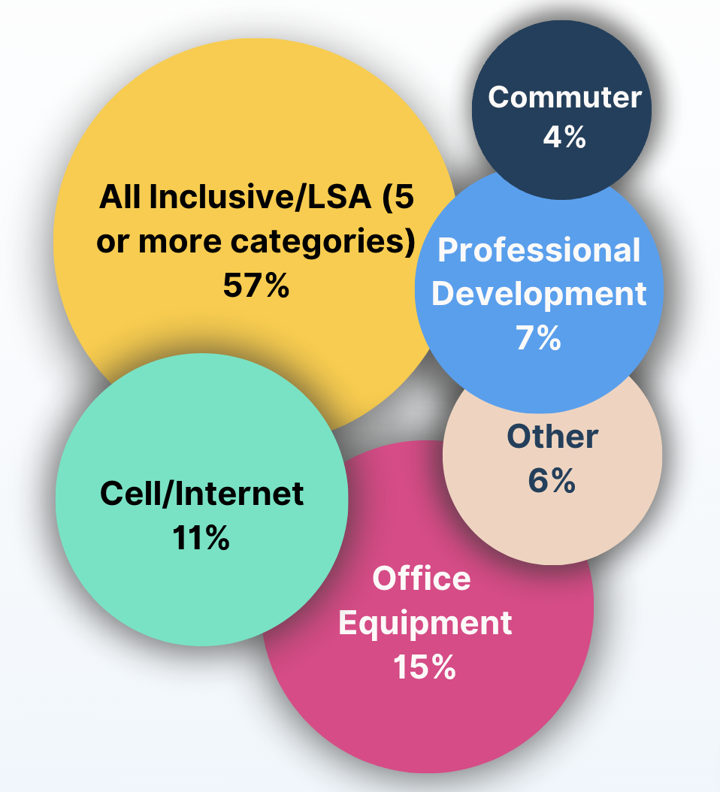

All-inclusive LSAs continue to dominate company offerings, with 57% of stipends occupying this category.

Emily Goodson, CEO of CultureSmart, coaches businesses on how to build an inclusive workplace culture and notes how these all-inclusive benefits support that aim:

“The correlation you see between higher program utilization and multiple stipend categories makes sense because the approach is more inclusive. Years ago, companies would offer employee gym stipends to one organization, location etc. While well intentioned, this approach excluded people with certain schedules, preferences, and abilities.

You also see this holistic approach validated by the quantity of unique vendors used on the Compt platform in 2023. Wellness benefits are not one size fits all and employees want a vendor that aligns with their specific values, identity, and life experience.”

Regardless of industry, company size, or budget, lifestyle benefits are a simple, yet powerful solution companies can use to address challenges around employee engagement and retention. By providing employees with a high level of personalization, you can foster a culture of support, ultimately enabling employees to bring their best selves to work.

Want to uncover all of the insights from our benchmarking study? Download the full report here.