A lifestyle spending account is an employer-provided account employees can use to spend on a wide variety of lifestyle benefits.

By Amy Spurling

According to a 2023 study by Zippia, only 65% of workers in the United States are happy with their job.

It's no secret that finding and retaining the best talent has been a major organizational challenge for employers over the past few years. That’s where a lifestyle spending account can come into play.

Here's what is covered in this guide:

A lifestyle spending account is an account employees can use to spend on lifestyle benefits. These accounts are also referred to as lifestyle benefits, perk allowances, lifestyle reimbursement accounts (LRAs), and specialty accounts.

Employees can decide what they spend the money on, which increases their engagement with their job and loyalty to their employer. Plus, HR isn’t burdened with the administrative work that comes with managing these benefits. It’s a win-win solution.

There are numerous benefits that come with lifestyle spending accounts.

Unlike healthcare accounts, LSAs are for a wide range of perks. LSAs are more inclusive benefits because employees across generations and states can decide how to use perks that best fit their lifestyle.

Giving employees control over their spending increases loyalty to your company and promotes a healthy work-life balance. Happier employees translate to higher employee engagement and more success within your company.

With LSAs, HR no longer has to designate lifestyle benefits for employees. Instead of spending multiple hours per month on perks for each employee, HR will only spend an average of one hour per month managing them, whether a company has 100, 1,000, or 10,000 employees.

Companies can offer benefits that employees really want, which boosts retention. Additionally, remote or hybrid employees are able to get the same LSA benefits as those working in the office.

Providing inclusive and diverse benefits helps companies show they care about their employees and want them to be happy. This promotes a positive company culture and helps attract, retain, and engage top talent.

Most employers offer traditional benefits like health insurance and a 401K. LSAs can address benefit gaps and help you attract and retain the best talent.

For example, if one of your core values is "continuous improvement and learning", you could offer a professional development stipend that allows employees to spend their funds on continuing education courses.

Having funds for a gym membership can encourage employees to develop healthy habits that positively impact their physical health and work performance.

It’s important to note that there are disadvantages to lifestyle spending accounts, too. By learning about the pros as well as the cons, you can decide if LSAs are right for your company.

This is a disadvantage for employees since employers get full discretion when it comes to the limits they set. As an HR professional, it’s crucial to identify a benefit amount that is generous to your employees while still ensuring you’re staying within budget.

LSAs are taxable benefits for employees. However, Compt can manage taxable vs. nontaxable stipends and provide the ultimate flexibility due to our reimbursement model.

More on taxes will be covered in the next section.

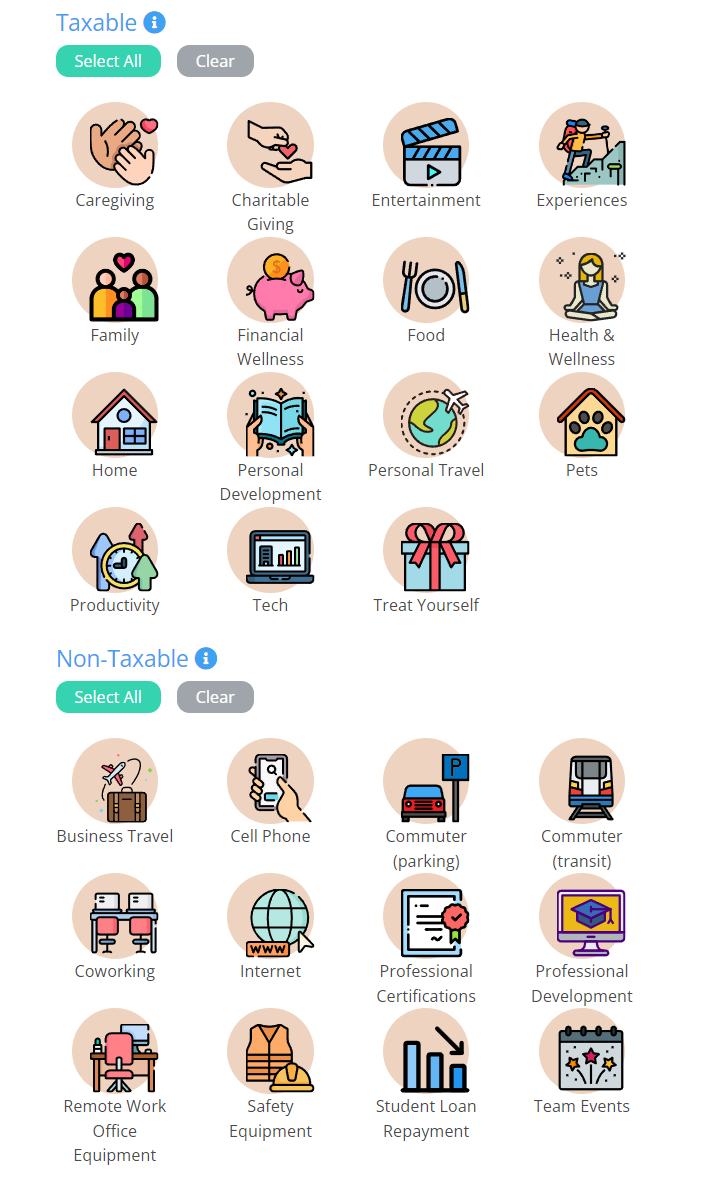

Compt's 27 Categories

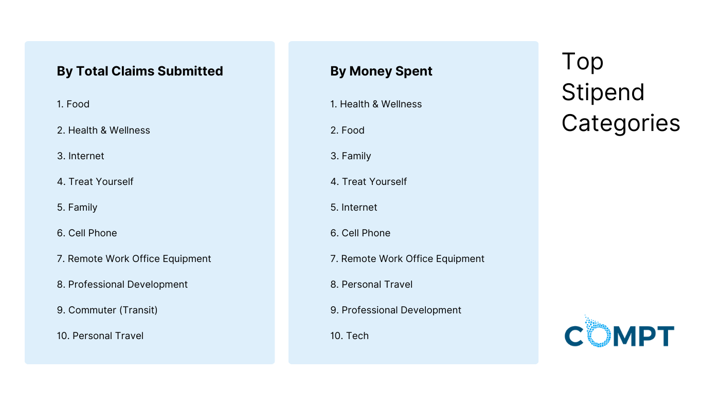

We conducted a comprehensive study of lifestyle benefits data and uncovered the top benefits employees want.

Some employee benefits aren’t taxed – but LSAs are. Here is some more information on how taxes work.

When employees spend the money from their LSAs they will pay taxes on it. This differs from HSAs, HRAs, and FSAs, which do not tax employees when they make withdrawals. The flip side is that because LSAs are taxed, they allow for much more flexibility when it comes to how employees spend their money.

Come tax time, employers will include the amount of every LSA reimbursement in each employee’s gross income. Any amount that an employee rolled over or gave up would not be included in their taxable income. It’s up to an employer whether or not LSAs would be rolled over from year-to-year or forfeited.

Note that an LSA could be subject to ERISA (Employee Retirement Income Security Act of 1974) if employees use it to pay for health/wellness expenses. It’s a good idea to consult with an employment lawyer when creating any sort of benefits program, especially when offering employees LSAs.

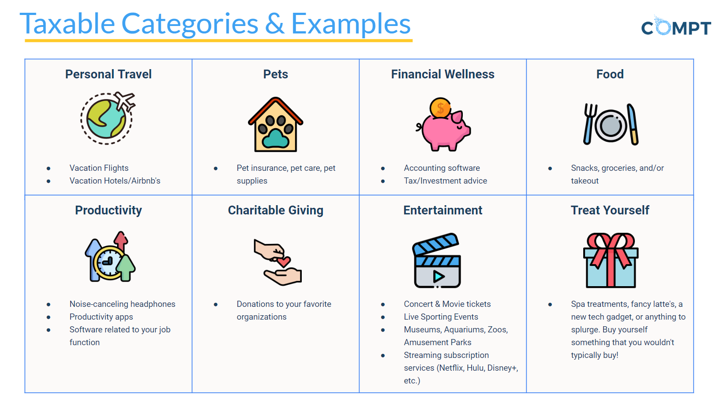

It all depends on what employers say it can be used for, but typically, it will include benefits for health/wellness, remote work, and professional development. It’s important for employers to survey employees and find out what kind of benefits are most beneficial to them to help them feel healthy and fulfilled.

Some unique uses we've seen include nutritional supplements, financial wellness planning, and more!

Along with hiring an employment lawyer and/or making sure your legal team reviews your LSAs, you should review the rules laid out by ERISA just to be safe. For instance, if the LSA covers medical expenses, it could make it subject to ERISA. This is a problem you’ll want to avoid.

LSAs are ideal for companies that want to see higher fringe benefits utilization. They are also great for employees who are craving work-life balance and could benefit from the personalization of these benefits. You’ll need to ask your employees what kinds of benefits they would like to have access to and then decide if it’s worth investing in LSAs. Look at what similar companies in your field are doing before getting started and check out our blog: 39 Surprising Statistics About Lifestyle Spending Accounts (LSAs)

Popular Perk Categories, Compt 2024 Benchmarking Study

Yes, remote work stipends are a category of lifestyle spending account. A remote work stipend can include:

If you are interested in learning more about how to build the perfect perks program for your distributed team, visit our guide on remote work stipends.

A lifestyle spending account is different from other spending accounts like flexible spending accounts (FSAs) and health savings accounts (HSAs). We'll go over the key differences below.

A lifestyle spending account is not the same as a Health Spending Account or an HSA. Unlike an LSA, an HSA is a savings account that allows employees to set aside pre-tax money to pay for covered medical expenses. Employees must be enrolled in a High-Deductible Health Plan (HDHP) to use an HSA. There is a $3,600 limit for individual contributions and a $7,200 contribution limit for families. If employees are 55 or older, they are allowed to contribute an extra $1,000. The funds will roll over from year to year so employees won’t lose them at the end of the year.

Another type of healthcare benefit that some employers provide is a flexible spending account (FSA). It’s an account that allows employees to cover copayments, some medications, deductibles, and other healthcare expenses. Employees (and some employers) put money into an FSA and will not pay taxes on their contributions. They will need to submit a claim to the FSA through their employer and show that they had a medical bill that their healthcare provider would not cover. The maximum FSA amount per employee per year is $2,850. The money that employees contribute is forfeited if they don’t spend it within the plan year.

Unlike a lifestyle spending account, an HRA, or Health Reimbursement Arrangement, is only for healthcare expenses. They are employer-funded group health plans that allow employees to pay for qualifying medical bills. Employees need existing healthcare coverage to participate in an HRA. They will not pay taxes on the money in it and unspent money can be rolled over into the next year. However, an employer has the right to determine the maximum amount that can be rolled over.

Are you interested in setting up your own lifestyle spending account program? Here are the steps you can take.

Count the number of employees you have and create a total budget for all of the lifestyle spending accounts you’ll be providing. You can look at what other companies in your industry are doing to ensure your benefits package is competitive.

Usually, timeframes are monthly, quarterly, semi-annually, or annually. Figure out which one is right for your company.

These categories could align with your company goals or values or employees could be given 100% autonomy when it comes to the perks they choose. Many employers will provide health/wellness and remote perks, but it’s up to you and your team to determine what’s best. Remember to take your company culture into consideration when making these decisions.

There are a number of LSA vendors out on the market--Compt is the only one that operates exclusively using a reimbursement model.

Some key benefits of Compt:

-100% tax-compliant: Compt is built to comply with the US tax code, which means Finance/Accounting doesn't have the headache of calculating tax liabilities.

-No pre-funding: Unlike gift cards, which require you to frontload funds, our reimbursement model means you're only liable for the purchases made by employees.

-Personalization: Employees can spend their money on goods and services that are personally beneficial to them (for example, some employees would rather go to their local yoga studio than purchase a gym membership). With a marketplace model, which only allows employees to purchase from pre-selected vendors, this flexibility is absent.

Click here for more guidance on how to evaluate the pros and cons of different LSA vendors.

Once your LSA is officially set up, you should send out a company memo explaining the program to your team.

Make sure you include relevant information like:

Having open communication with your team when creating your LSAs is key to its success.

We see so many amazing HR and People teams use Compt to give their teams flexible lifestyle benefits and personalized perks. In fact, seeing all the support these companies give their employees is one of OUR perks! We truly believe that people will do their best work when they’re supported and thriving in inclusive environments, and that’s what we see every day with our customers.

What’s particularly exciting is when a company has a very high utilization of the lifestyle spending accounts inside their organization.

Note: When we say “utilization” we mean the percentage of dollars used in a given stipend program. So a program with 80% utilization means $0.80 of every dollar offered is used.

We looked at the organizations that have deployed Compt to manage their lifestyle spending programs with the highest utilization rates across every company we see. We wanted to compile some of the innovative programs that these companies are managing with Compt. With their permission, we have listed eleven of the top twenty organizations with the highest utilization rate in their stipend programs.

Every one of these amazing companies had a utilization rate of at least 85%.

With Compt's reimbursement platform, you can easily create, automate, and manage your LSA while integrating with your existing payroll systems.