An employee stipend is a sum of money given to employees dedicated to cover perk and benefit expenses. Common types of stipend categories include health & wellness, professional development, food, and more.

By Amy Spurling

As the old way of selecting individual vendors for perks becomes less valuable for employees and more administrative-heavy for HR, companies are leaning on employee stipends to solve both problems while further delighting their people.

That's why we developed this guide with everything you need to know about this fringe benefit: stipends.

First, a definition:

An employee stipend is a sum of money given to employees dedicated to cover expenses for various perks and benefits.

Employee stipends help employers put the money and choice in the hands of employees so they can get the lifestyle benefits they want and need most.

They're also referred to as:

They are becoming increasingly popular in today’s work climate because they dramatically improve the process of offering perks and benefits for HR team members, streamline accounting and taxability for finance teams, and more importantly, improve the experience for employees.

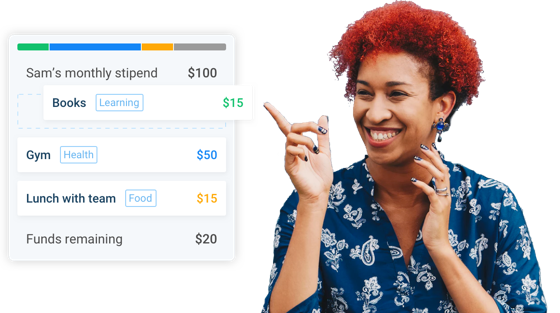

In the example to the left, Sam's company has allocated $100 per month to her and other employees to spend on the following perk categories: continuous learning, health & wellness, and food.

This month, Sam purchased books, a gym membership, paid for lunch with her team, and still has $20 remaining.

How would you spend $100 this month?

We're living in the age of personalization. Everything in our daily lives from our Netflix subscriptions to Spotify playlists to iPhones is customized to us and our unique preferences.

Employee stipends, or lifestyle spending accounts, are the best method for companies looking to introduce more personalization to employee benefits without adding complexity.

Here's a short list of companies using employee stipends:

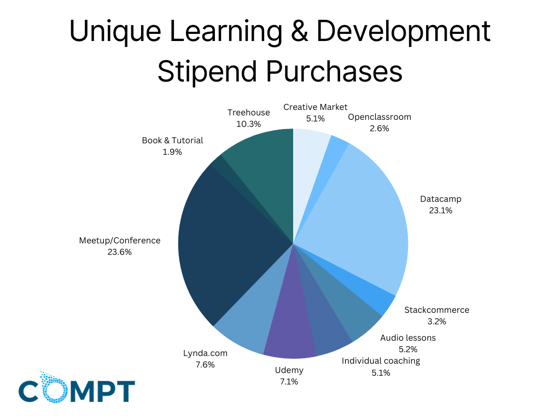

After analyzing their employees' stipend usage, they noticed their people were using many different platforms to learn.

15 unique platforms to be exact.

How could HR create a program that supports this diversity of needs?

This is the power of an employee stipend. 👉

Below are some of the more popular stipends we see at Compt:

Don’t have time to go through this comprehensive guide right now? That's ok!

You can read this content later but still take advantage of additional information about perk stipends! We like to make it simple.

This new approach to employee perks has seen a lot of media attention (and attention from HR influencers) because it solves so many common problems of traditional perk programs and it also addresses the trends that are shaping the future of work.

So what exactly are the benefits for companies and employees?

Employee stipends give your team access to the lifestyle benefits they actually want and need.

Pet insurance, in-office yoga, and financial planning services are excellent perks, but often only a small percentage of a team can or will use them. And as you already know, low utilization is a quick way to burn cash and burn yourself out (because you're the one managing them all!)

Stipends create a flexible, personalized perk experience, and since your employees get more control over how they use it, they're more likely to engage. That's a budget win!

HR is no longer forced into trying to pick the "perfect perk" or perfect vendors with its limited budget and time.

Save time and money on the implementation side as well as ongoing administration and maintenance.

When you choose the stipend approach, you'll only be managing one vendor which means less time-consuming and labor-intensive tasks and more automation.

When you use Compt to set up stipends, you tap into our employee reimbursement system, which streamlines the process of setting up spending categories with an unlimited number of vendors. This means your employees can buy what they need and get reimbursed through the platform, allowing them to shop anywhere from major retailers like Target or Amazon to their favorite local bookstore or ice cream parlor. In fact, in the past year alone, our customers have accessed over 80,000 unique vendors [source: Lifestyle Benefits Benchmarking Report 2024, Compt]. This level of customization wouldn't be achievable without our reimbursement model.

[Want to see how much your perk vendors are costing you today? Visit our Vendor Calculator.]

If you're managing stipends manually right now, then you know the signficant effort that goes into ensuring accuracy, tax-compliance, and keeping the employee data private and secure.

When you opt for a software like Compt, your CFO and IT team will be able to sleep comfortably at night knowing your perks are appropriately taxed, error-free and secure. And, they have you to thank for that.

With Lifestyle Spending Accounts, companies no longer experience expired food, wasted event tickets, or under-attended in-office fitness sessions.

Choosing Compt also means that you don't have to lock up money by pre-funding spending accounts or debit cards with money that might never be spent or go to employees that quit or are fired. Compt's reimbursement model ensures that the only money you need to spend, is the money that employees actually utilize.

While a LinkedIn Learning account for every employee might sound like a great idea, what percentage of your team actually uses LinkedIn to learn, or can even access courses for their profession? The consequences of this type of cookie-cutter or one-size-fits-all point solution means you're investing time and resources into programs that not everybody wants or likes.

With stipends you move from point-solutions to spending categories, and in this case, your "Continuous Learning Stipend" would allow people to purchase from LinkedIn Learning, Udemy, Coursera, extension universities, books, conferences, coaches, and more.

Gain a competitive edge by approaching perks strategically and aligning them with what matters to the business.

If you already offer your team a stipend, awesome! You're ahead of the curve and you're likely experiencing a tremendous amount of the benefits mentioned above. High-five!

However, there's likely a problem you're encountering right now and that is: the admin work.

Unless you're using software to streamline the management of your employee stipend, you're likely spending countless hours managing the following:

If these found familiar, you're not alone. Some companies we've spoken to Compt told us they were spending 20+ hours a week managing these details for a company with less than 200 people. That's 50% of one person's week, or worse and likely more accurate, a percentage of multiple peoples' time invested just on managing the process.

If you feel like the cost of managing the administrative tasks and work is too much to handle, consider implementing a perk stipend management software.

We want to help you select the best stipend solution for you and your people, so we've built this handy worksheet with the top criteria people consider when evaluating vendors.

Curious about what people actually spend their stipends on?

We've pulled together some actual purchases from Compt users.

Learn more about health and wellness stipends.

Learn more about Remote Work Stipends.

Learn more about learning and development stipends.

Learn more about family stipends.

Whether you're creating a perks program or a lifestyle benefits program from scratch or are looking to make updates to an existing one, adding personalization to your perks program can achieve many of the same goals that traditional perk programs do, while giving you (and the rest of your organization) more benefits.

Companies usually begin looking to employee stipends when they want to:

Setting up a traditional perk program from scratch takes seven steps and constant tweaking to get it right. Employee stipends or Lifestyle Spending Accounts allow for an easier, more time-efficient process and happier employees.

1) Identify your current number of employees and your total budget for employee lifestyle benefit accounts.

2) Determine how much you'd like to spend per employee per timeframe.

Timeframes could be monthly, quarterly, semi-annually, annually, or on a one-time basis.

3) Select categories for employees to spend in.

These could align with your company's mission, values, and goals, or be 100% open to give employees complete freedom over their perks. Popular categories include health & wellness, continuous learning, family, food, and travel.

Below are some of Compt’s most popularly used employee stipends (categories in which employees can spend their perk money):

4) Set up your program.

If you use stipend management software like Compt, this could take 15 minutes.

Or if you're doing it manually - develop a spreadsheet/form where you can manually track the individual perk expenses, total amounts remaining within each time frame, collect receipts, account for taxes, data for finance, and the status of each perk expense.

5) Lastly, communicate the new benefit to your team.

Draft up an email and a page on your internal wiki to communicate the new perk and benefits plan.

Remember to explain the why, what, when, and how details, so people understand the value and how to take advantage.

To supercharge your communication plan, create a forum for people to provide feedback. A simple Google form can help or hold a series of office hours.

[Starting with stipends? Check out this detailed guide on how to set up your perk stipend.]

Compt's stipend administration software makes it simple for organizations big and small, remote or in-office to efficiently expand their benefit offerings. Learn how you can provide custom lifestyle benefits in minutes each month with Compt.