A work from home stipend is money given to an employee, in addition to their base salary and benefits, for them to cover expenses incurred while working remotely.

Last updated February 12, 2024 by Sarah Bedrick

They have more flexibility, spend less time commuting, and have greater work-life balance than ever before - which is exactly why they don't want to return to the office. In fact, a recent Gallup report found 3 in 10 hybrid employees are "extremely likely to change companies" if not offered remote flexibility.

That's why companies that adapt to the needs of their most important asset - the people! - are coming out on top as the best companies to work at.

The ideal method for supporting your remote employees, which is also the most flexible and scalable option for HR, is a remote work stipend - also known as a remote work allowance, remote employee reimbursement, or a work-from-home stipend.

We developed this guide to give you everything you need to know about remote work stipends.

Here's what is covered in this guide:

First, a definition:

A work from home stipend is money given to an employee, in addition to their base salary and benefits, for them to cover expenses incurred while working remotely.

A work from home stipend can be designed for employees in one or both ways:

Further details on what they are:

Curious what else can be classified under a remote work stipend?

(Compt customers have 90% engagement rates!)

Companies are embracing stipends and reimbursement policies to better support their employees.

The perk stipend model has numerous advantages, including improved perk and benefit management, simplified tax handling, and the ability to enhance other important aspects of the business like culture, talent retention, inclusivity, and employee engagement.

Remote work stipends are also highly sought-after by HR and finance professionals as a valuable new lifestyle benefit.

Here are even more specific benefits of a remote stipend or reimbursement program:

One of the most impactful and relevant benefits of offering a remote stipend as a perk especially today is that it's adaptable for ANY working environment - whether it's a back to the office, 100% remote, or something in between in your own version of a hybrid work model.

If you use software like Compt, IRS compliance is automatically taken care of for you, making your HR and finance teams' lives' easier.

(Note: While it's very common for companies under 100 employees to overlook the need to ensure tax compliance in their perk offerings, growing companies know how critical it is to have all employee compensation-related programs (like stipends) be done "by the book".)

Your team gets access to a broader base of benefits without needing to increase the overall budget. Because the pool of money is distributed to people, they pick what’s best for them instead of picking a few perks that everyone gets (but rarely everyone uses).

Help employees get what they need when they need it, regardless of where they live.

By eliminating the complexities of vendor management in multiple locations and the need to oversee various software systems, stipends offer a streamlined solution for HR operations.

It is widely recognized that traditional perk offerings incur unnecessary expenses on two fronts:

With stipends, these inefficiencies are eliminated, ensuring timely provision of individualized benefits to all recipients, thus optimizing your resource allocation and minimizing wastage of both financial and time-related expenses

Remote work stipends offer strategic benefits for organizations that leadership loves, by aligning with company culture and values, providing scalability, promoting mindful spending, and fostering deep connections with employees.

By tailoring your companies perks to match your company's culture and values, you can offer benefits that resonate with your employees on personal levels. Whether it's a continuous learning stipend or a health and wellness stipend, they demonstrate your commitment to investing in these values.

Another strategic benefit is that they're scalable. As your company grows or undergoes headcount changes, the inherent nature of stipends is their flexibility which makes it simple to scale remote work investment up or down, while remaining relevant to your employees needs.

CFO appreciate when money is invested well, and stipends ensure that happens. When employees are given the autonomy to choose how they allocate their funds, they become more deliberate in their spending decisions. This sense of responsibility encourages employees to spend in more thoughtful ways which align with their priorities.

Remote work stipends enhance the connection between employers and their team because they demonstrate and create trust. When people get to exercise autonomy and are treated as experts of their own world, the relationship deepens.

If you're still wondering why your remote team should have perks, here's a piece detailing why your remote employees need support like your on-site team members.

Below are nine examples highlighting the unique approaches to remote work stipends, with varying remote work policies:

1) HubSpot: A hybrid-remote company provides their people:

2) Webflow: A company with 70% of its team remote around the globe provides 3 stipends for their team:

3) Basecamp: A fully remote company offers 4 stipends for their team members:

4) Buffer: A fully-remote company offers several stipends as well:

5) Gusto: A hybrid team with many employees working from home, some or all of the time, offers two stipends:

6) Gimkit: A fully remote company offers the following stipend:

7) Zillow: 90% of the workforce works from home at least part of the time:

8) Almanac: A fully remote company with employees across the globe:

9) Calm: A remote-first company:

Download the free Lifestyle Spending Accounts Guide to learn why they're the most low-maintenance, budget-friendly, and inclusive benefits for your people.

The answer to this isn't as clear-cut as other stipend categories, as it all depends on how you want to support your remote employees.

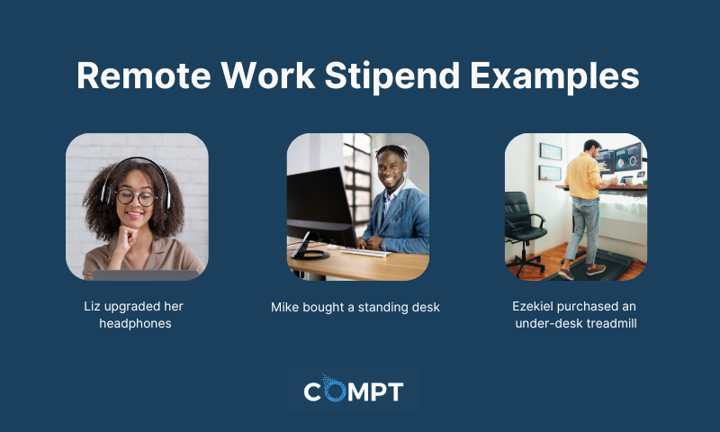

Below are some examples of eligible expenses for a work from home stipend:

If you'd like to see a list of other items that employees can buy with their work-from-home stipend, check out this recent post.

Below are some examples of reimbursable expenses, if you are setting up your remote work stipend to cover similar perks offered to in-office employees:

The broad-based categories are a deliberate approach to remote perks. With this approach, you're able to avoid building out a long list of vendors and initiatives you'll cover. If you do want to pick specific vendors that employees can spend with, then you may want to go with a vendor-based approach.

Use our Perks Vendor Cost Calculator to determine the expenses associated with your remote work stipend vendors. Identify potential savings by consolidating with Compt (which your CFO will love).

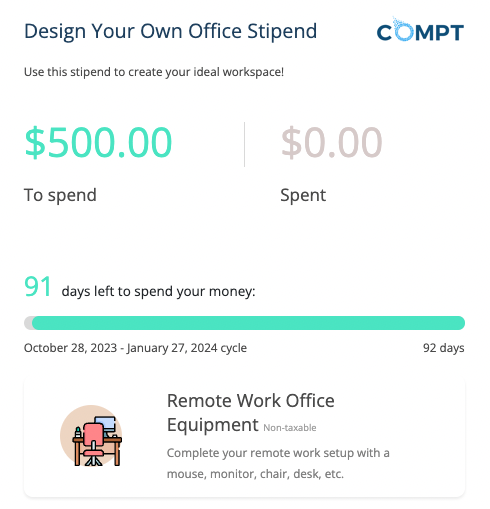

Some examples include offering $100/month, $500/quarterly, or $2,000 annually.

Decide whether you want to offer a stipend only to remote team members or one to them in addition to what you offer all employees.

[If you are interested in getting insight into what the most successful companies do, we are happy to share examples and use cases our customers are seeing success with. Reach out to talk to a stipends expert today.]

In the examples above, you'll notice that they most often surround a category of spending like health and wellness, continuous learning, family, or travel.

Doing it this way allows you to create a custom program for your team and then allows 100% personalization for them.

If you're looking for ideas for spending categories beyond a remote stipend, consider tying them to your company's culture, goals, or important cultural initiatives.

Managing the remote work stipend manually

If you choose this option, be prepared to set up a process to track purchases, receipts, balances, approval, and paid perks, as well as rejections or ones which need further review. Consider using Google forms to track submissions, and Excel or Google sheets to track progress, and create a process to track the nontaxable vs. taxable (for IRS compliance).

Choose stipend software to help you manage this

Options like Compt can help communicate your programs to your team members, track balances and spending, scale the process for you, automate a large portion of work, and provide valuable data insights around engagement and utilization. For situations where IRS compliance is a non-negotiable, Compt will make you and your finance team's job much easier because it's 100% IRS compliant.

If you're looking for more information, we wrote an in-depth guide to set up a lifestyle spending account here.

Below is a list of popular stipend categories:

Generally, work-from-home stipends are considered taxable income.

Work-from-home stipends are not considered part of an employee's wages or salary—so the employer will not withhold taxes from that income, including Medicare or Social Security.

But work-from-home stipends are considered income.

That means that they'll increase your taxable income for the year—so in the end, you'll end up paying taxes on your stipend income.

Because companies approach work-from-home stipends so differently, there's no single typical example of a work-from-home stipend. For example, some companies give employees a one-time stipend to help them set up their home office (like Google, which gives remote employees a $1000 stipend to get their home offices up and running.) Others opt to give employees a monthly stipend (for example, $75 per month) to cover WFH-related costs, like internet, phone, and electricity. And others opt to do both.

Not only are the payment structures different, but the amount of the stipends can vary based on a variety of factors—for example, the cost of living in the area where the employee works from home or whether an employee is fully remote or spends some time in the office.

As mentioned, while stipends are not considered wages, they are considered additional income—and, as such, are also considered taxable.

However, how a company pays for your internet can determine if it's taxable. Stipends are generally taxable—while reimbursements are not. So, if a company gives an employee a stipend, it's considered taxable. But if they reimburse the employee for out-of-pocket expenses—and include internet costs in those expenses? The reimbursement would not be subject to taxes.

There's no way to know exactly how many companies offer remote work stipends. For example, buildremote assembled a list of 101 companies that offer WFH stipends. But that list is by no means exhaustive and doesn't include small companies—many of which offer a variety of perks to their employees, including remote work stipends.

While there's no way to pin down exactly how many companies are offering WFH stipends, it is fair to say that the number of companies offering remote work stipends increased in the wake of COVID-19, when a huge percentage of companies shifted to full or partial remote operations.

With Compt's stipend reimbursement software, you can easily create, automate, and manage your remote stipend programs while integrating with your existing payroll systems and track engagement rates in real-time.