Charitable giving stipends are employer funds employees can designate to any charitable cause of their choice.

By Amy Spurling

Whether it's ongoing support for a cause you align with your company, a one-time donation or fundraising event, or an effort to help employees pursue philanthropy, charitable donations bring untold value to your organization.

For companies starting out, it can be difficult to know how to get started with giving back.

Here's what is covered in this guide:

How to set up charitable giving stipends for your company

First, a brief definition:

Charitable giving stipends are employer-funded donations employees can designate to any charitable cause of their choice.

Employees can use these stipends to donate directly to a charitable organization, or the company may opt for more structured giving programs where employees can pledge a certain amount and the company matches it up to a predetermined limit. Often, employers give stipends to incentivize volunteering (i.e., a volunteer grant).

Aside from cash, charitable giving stipends can be used for gifts of property and equipment. They may also cover travel expenses for staff members who are participating in a charity event.

They're an essential part of a wider employee giving program, which helps your company establish a culture of service and appreciation and reinforces your larger purpose.

A brief note on the tax implications of charitable giving stipends:

Employee giving doesn't have to be complicated. Learn how charitable giving reimbursement through Compt makes donating easier for you and your employees.

Companies use charitable giving stipends in one of two ways, which makes them easy to set up.

If you already have some sort of donation-matching or volunteer incentive but want to make it easier and more accessible to boost participation, charitable giving stipends can help. You can set up a system that automatically sends employees monthly or quarterly payments designated as donations to the charities of their choice.

Example: A software company might already have a program in place that matches donations up to $2,000. They could try offering all employees an additional $500 stipend each year to donate to whatever charity they want – with the bonus of matching employee donations up to $2,000.

If you're just starting out, you can use charitable giving stipends to launch a new employee giving program. You can start small and gradually increase the amount of stipend funding over time. This way, your company benefits from increased employee engagement while building positive relationships with charities or organizations that align with its mission.

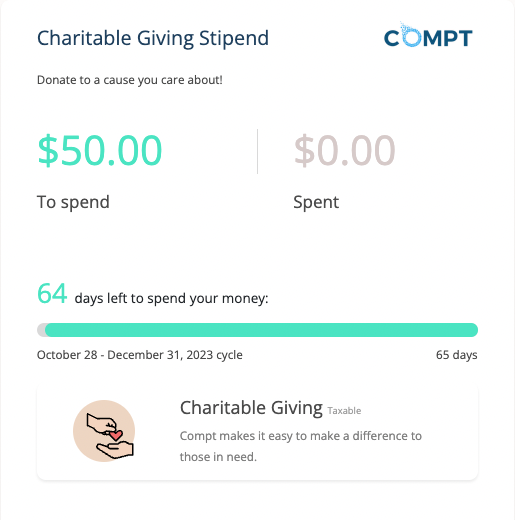

Example: A boutique marketing agency already offers its employees perk stipends, so they decided to add charitable giving stipends to their existing perk program. They created a system where employees receive $50 per quarter, which they donate to whatever cause they choose. The agency also matches employee donations up to $500, so employees feel incentivized to get involved with charity work.

Across the board, one thing is for certain: companies are stepping up their game when it comes to employee giving. The combination of a global movement toward increased corporate social responsibility and innovative new technology has both inspired and enabled companies to contribute like never before.

Learn how to set up a stipend-based employee giving program here!

Of course, the growing trend these days practically mandates corporate social responsibility (CSR) initiatives. 93% of employees believe companies should lead with a purpose. 76% say they should make positive impacts in their local communities. And a huge factor influencing job satisfaction? The ability to make a difference.

The vast majority (70%) of consumers agree. They want to buy from companies that prioritize social impact.

The easiest way to prove your social impact? Get employees involved in giving back. That’s where charitable giving stipends come into play.

Aside from the obvious PR boost, there are plenty of tangible benefits to offering a donation-matching program.

Encouraging employees to donate to causes they're passionate about helps you build relationships and trust in local communities. It also helps you establish a company culture that puts community engagement at the forefront.

According to data from BrightFunds, companies with employee giving programs are twice as likely to be engaged at work, 5.6x likelier to trust company leadership, and have a 3.6x higher chance of recommending their company as a great workplace.

Employees want the companies they work for to make an impact, so when your company provides an outlet for donations, you’ll be more attractive to job candidates. Plus, current employees will appreciate their opportunity to give back on behalf of the company.

What good is a charitable donation program if your employees won't use it?

Research from America's Charities tells us the average participation in employer-sponsored giving programs is just 10%. Tons of employees want to give back, but they might not be interested in a volunteer-based stipend or the hassle of organizing a fundraiser.

Charitable giving stipends make it easy for employees to donate and get involved with their favorite nonprofits without the extra hassle. All you have to do is set up the program, provide employees with information on how to use it, and let them do the rest.

Employees can log in to your platform of choice (like Compt) and select a charity they want to donate to. They can also donate directly from their paycheck if they prefer.

Just because your employees can use your program doesn't mean your HR team can.

Finding and working with bona fide nonprofits is a massive headache come time for tax season. Stipend software is fully-managed and 100% tax-compliant, so your CFO, HR back office, and accounting teams don't need to worry about dealing with the technicalities.

Compt is now integrated with Givz. Now, Compt users can directly donate to any of the 1.6 million+ registered 501(c)(3) charities in the US. And HR can manage their entire program in just 30 minutes per month.

Now for the fun part. If your organization makes charitable contributions through stipends, there are tax benefits. And no. They aren't straightforward.

You probably won't reach these limits with employee stipends alone, but you certainly might if you have other charitable initiatives like volunteering, company donations to public charities, or sponsorship of events.

Charitable giving stipends are one of the best ways to offer meaningful employee perks to your team. Not only do they help you show the world that your company is dedicated to making a difference, but they can also have a huge impact on morale and engagement in the workplace.

Plus, they're lots easier to set up.

Figure out how much your company can afford to give each month. It doesn't have to be a huge chunk of change. Start with stipends of $50 to $100 per employee and work your way up.

When setting up your charitable contribution program, you have a few options when it comes to timeframes:

It all depends on how you want to incentivize employee participation. For example, some companies host donation drives around the holidays or celebrate the end of a quarter with a special incentive (that includes donations).

Use Compt to manage and track your charitable donation program. Set parameters for your stipend, including dollar amount, time of disbursement, and frequency. Then, employees can choose from more than 1.6 million 501(c)(3) nonprofits to donate to.

Not a customer? Schedule a demo.

Once your program is ready to go, you'll want to let everyone know about it. Send an email and create a Slack channel that explains how the donation process works and what charities they can donate to.

Be sure to include as much detail as possible so employees understand all of their options. And don't forget to shout out employee donations in the messaging channel!

Just getting started with stipends? Check out our guide to setting up perk stipends for the first time.

A perk stipend makes it possible for companies to offer more lifestyle benefits, with less money and ensure that they are personalized to meet the needs of their people.

Are you ready to set up a charitable giving stipend?

Employee giving doesn't have to be complicated. Learn how charitable giving reimbursement through Compt makes donating easier for you and your employees.