A meal allowance, also known as a food allowance, meal stipend, or employee meal benefit, is a predetermined amount of money provided to employees for the purpose of purchasing food.

Updated April 2, 2024 by Sarah Bedrick

Meal allowances, also known as food allowances, are a relatively old concept. Depending on a person's functional role within an organization, companies would give their people meal stipends to use when on travel and/or taking out customers or prospective clients.

Fast forward to today, the idea of a meal stipend has transformed quite a bit. Meal stipends are gaining traction because organizations that once catered in-office lunches or snacks for their people are now realizing their limitations. They are now implementing more inclusive ways to support their employees' food needs and give them the power of choice.

Here's what is covered in this guide:

First, a definition:

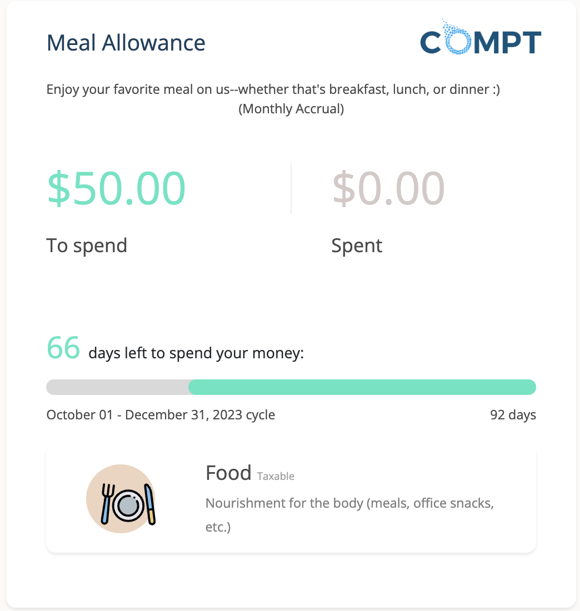

A meal stipend is a predetermined amount of money provided to employees for the purpose of purchasing food.

The stipend funds can be used for buying lunch for remote employees, or items like snacks, groceries, and beverages that will make their working experience more convenient, healthy, productive, and supported. Some even call them a grocery allowance because they're so flexible for your employee's food needs. It's easy to see why meal stipends are one of the best employee benefits.

Compt customers see 90%+ employee engagement rates!

The tech industry, typically a first mover when it comes to unique employee benefits, has many companies that offer meal benefits. The BuiltIn community of tech startups, for example, lists over 1,000 different companies with "some meals provided" and a smaller number offering "free daily meals".

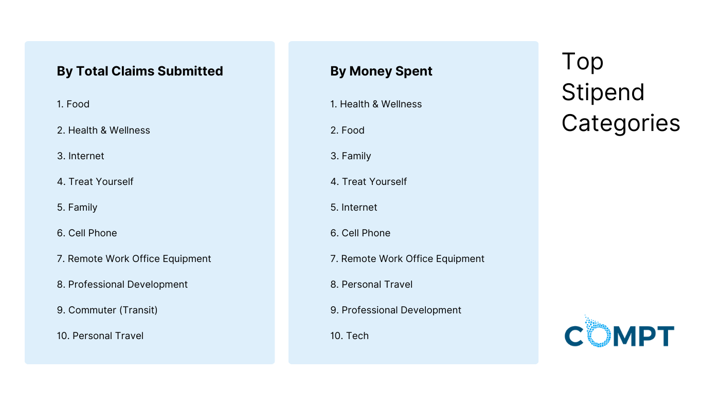

As we detail in our 2024 Lifestyle Benefits Benchmarking Study where we analyzed Compt customer stipend usage data, Food was the #1 category in which employees submitted claims.

Below are a few examples of top companies supporting their people with food allowances:

MasterClass's employee perks include $120/month as an interim snack stipend (due to COVID).

Snapchat gives its people $16/day for food.

Depending on the office, SAP would provide in-house catered meals or a food stipend.

Webflow has not set a meal-only stipend, but they do have a "Remote Work Stipend" which includes the option to buy food, tech, and productivity-related items.

Lose It! gives their employees $100 to spend on lunch delivery.

Want to learn more about all the possibilities with meal allowances and Compt?

Whether your employee is away for a few hours or staying for several days to attend a conference, it's likely they will incur meal expenses during their trip.

In such situations, providing a meal stipend to cover business-related meals such as breakfast, lunch, or dinner is a viable option. However, it's important to establish a clear meal allowance policy for employees to refer to before embarking on their journeys.

The federal Meals & Incidental Expenses (M&IE) rate serves as the standard benchmark for reimbursing employees for their business-related meal expenses while traveling. For the year 2023, the rate stands at $59 per day for most small localities in the United States. If you are considering a meal allowance for employee work-related travel, check out our Expense Management product suite, as these are considered business expenses.

Note that per diems are not considered wages and therefore are non-taxable.

Whether your team is in-office, remote, or hybrid, there are plenty of benefits to offering your people a meal allowance. Below we highlight the most common five.

Your people will purchase the food they genuinely need to make their remote work life easier and more comfortable. When people can easily refuel in ways that satisfy their convenience, tastebuds, and dietary needs, they're happier and more productive.

Catered meals were a staple in many offices across the nation pre-COVID. However, how many companies have been able to continue this since COVID began? Not too many.

As this Protocol piece points out, people are mourning the loss of their free lunches and snacks. You can stand out against the crowd by adapting and offering a food stipend today so that your employees get support for their most basic life needs.

Today more than ever, people's diets are varied due to preferences, intolerances, and allergies. With a food stipend or grocery allowance you're able to create an employee lifestyle benefit that supports everyone, regardless of whether they're paleo, vegetarian, vegan, gluten-free, dairy-free, and more.

If offering free lunches or meals to your people is a priority, this is one of the most cost-effective ways to do so.

Catered meals on-site are a thing of the past and it is also a time-consuming process to make sure the right amount of food is delivered, at the right time, while also ensuring people have the food they need (e.g. paleos, vegetarians, vegans), and the office space is cleaned up afterward.

Food allowances allow people to get their favorite foods while sticking to a budget, and without worrying about the time or costs of cleaning up.

If you want to see why they're so cost-effective, see how much you could be saving by using Compt to manage your meal stipend.

A food stipend is an easy and scalable way to set your people up with the food they want. Additionally, the right perk management software can also help ensure that taxes are accounted for, always.

Download the free guide to find out why employee stipends and lifestyle spending accounts are now the most common company perk.

At first glance, it might feel like you have to create a new budget for this, and while that might be the case, there are other options to find the budget. Below we break down the various options to creating a meal allowance program, by either getting new budget approved or consolidating an existing budget.

If you've already decided this is an important endeavor for your company and its people, then you're set!

If using a perk solution, be sure to count this cost into the budget. Or if you're managing them manually, you need to find a way to quantify this cost as well since the cost of time and labor to manage these is often a more hidden cost that will fall on HR.

If offering on-site catering for your people is a thing of the past, and that budget is still available, transition this money into a meal allowance. Learn how Compt can help you manage a meal stipend.

According to a recent SHRM report, about one-third of companies plan to extend the option for remote and hybrid work into the future.

To remain competitive for talent, companies need to evolve their fringe benefits and stipends to meet the needs of current and prospective employees. If you're looking for a way to serve your people in unbelievably meaningful ways, transition the "old perk budget" into a meal allowance, or even a remote work stipend or general perk stipend.

Setting up a meal allowance isn't a heavy lift for HR teams. Below we break them down into two steps.

Look to the examples above if you need inspiration, or use our Perk Vendor Cost Calculator which can help you identify the budget.

Keep in mind, you don't need to offer a lot of money to make a big difference.

There are three ways to manage a stipend program, and they include:

1) Managing the process manually.

If you choose this option, you'll need to set up a process to track employee food purchases, collect receipts, manage balances, process approval and paid-out food perks, as well as rejections or ones which need further review.

Keep in mind that food allowances are a taxable benefit!

Because of this, you might want to use Google forms to track submissions, excel or Google sheets to track progress, and create a process to track the nontaxable vs taxable (for IRS compliance).

2) Select an expense software to manage it.

Expense software solutions like Expensify and Concur are largely meant for business expenses which these are not.

If using this option, make sure every employee has an account with your company's expense software option and that you've also set up a way to track the individual employee food budgets (this prevents overspending), and work with your finance team to identify and execute on the best plan for accounting for taxes.

3) Select a lifestyle benefits software to manage it.

Options for employee stipend solutions have grown tremendously over the past few years as more people turn to inclusive and flexible options for their people.

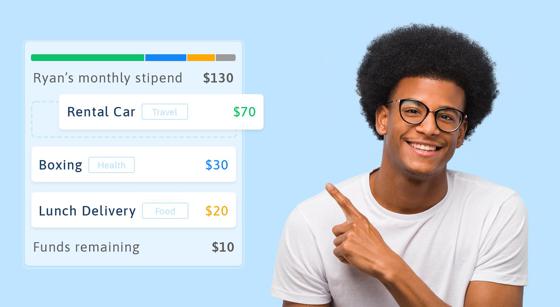

This kind of software can be especially helpful if it explains your food program details to your team members (and supports communication in remote teams), tracks their spending balances, and spending. Perk solutions should streamline your admin by having important information at your employees' fingertips.

There are more stipends than just a meal allowance. Have you done an employee benefits survey to see what kind of perks your team may want?

Do a Google search for “top perks” and inside almost every list is a surprising number of perk stipends.

So what are the other types of stipends or allowances? Below is a list of a few more you can consider implementing.

Stipends or allowances make it possible for companies to offer more perks as lifestyle benefits with less money and while ensuring that they're personalized to meet the needs of their people.

See how a meal stipend program can satisfy your team

Let's connect to see how a meal allowance - or any other flexible lifestyle benefit - can cater to all of your people's unique needs.