An employee travel stipend, also called a vacation stipend or travel reimbursement, is an allotment of funds that workers can use during each calendar year at their discretion to pay for personal travel expenses.

Last updated by Sarah Bedrick

Employers are increasingly realizing that encouraging employees to take paid time off work to travel and relax is good for the bottom line.

A recent U.S. Travel Association study showed a 22 percentage point gap between mega-travelers and homebodies when it comes to happiness with physical health and well-being - a powerful finding considering the rise of employee burnout.

So, to make sure their employees aren't squandering valuable travel opportunities to enhance their life (and actually use their PTO to do it), more and more employers are offering personal travel reimbursement.

First, a definition:

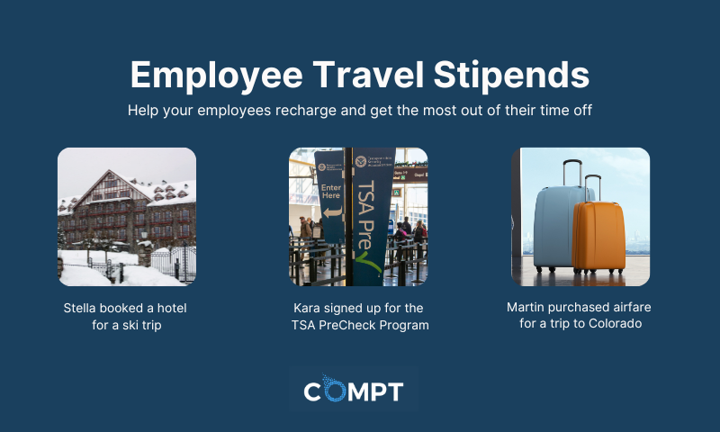

An employee travel stipend, also called a vacation stipend or travel reimbursement, is an allotment of funds that workers can use during each calendar year at their discretion to pay for personal travel expenses.

Companies that offer such a stipend for employee personal travel, which is different than business-related travel, are typically at the forefront of employee benefits and employee experience because it's:

Another thing to note is that there are no federal or state laws that require employers to offer a travel stipend to their employees, so they can establish their own requirements for how their employees can use it. For example, employees may need to submit photos proving they spent time at a vacation destination before receiving reimbursement.

Many employers already benefit by offering paid vacation time and encouraging employees to use it. Here are some of the specific ways that doing so can be good for business:

Offering an employee a travel stipend to spend on their vacations is a hugely attractive benefit to offer for attracting talent. It's a benefit that isn't standard, would appeal strongly to individuals who already love to prioritize travel on their off-time, and most of all... who wouldn't be excited to say "my company pays for my vacations"?

For your employees who have benefited from and become accustomed to this unique offering, it's very likely that it'll be a reason they stay longer at your company. This is especially true if you also have a healthy company culture that supports and appreciates their experience and contributions as an individual.

If you're interested in exploring travel stipends or any other type of stipend for your company, talk to a Compt stipend expert who can help you set up and manage your ideal program.

(Compt customers have 90% engagement rates!)

While each organization can determine what expenses qualify for an employee travel stipend, here are some common examples of vacation expenses to consider.

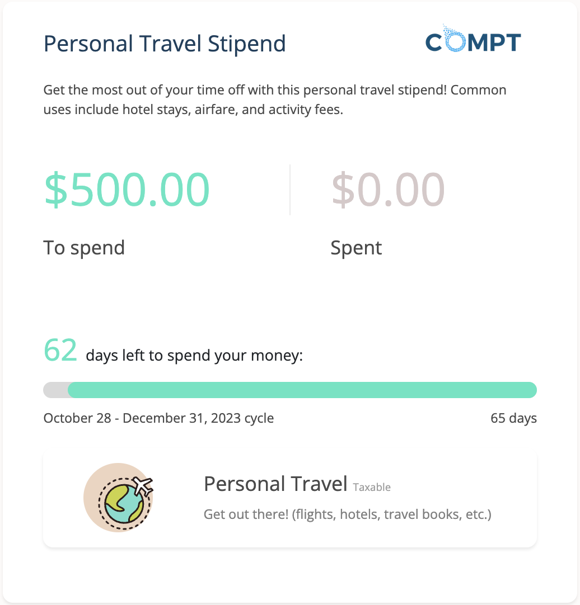

You can also offer a different stipend amount for employees with more seniority or based on excellent performance reviews, although we don't recommend that since the point of stipends is to promote equity and inclusivity.

You'll also have to think about how you'll offer the stipend and the verification requirements: will you just drop the cash into their paycheck (which has some tax pitfalls we cover in this post) or have employees submit receipts for reimbursement when they return to work after vacation (a standard and business-friendly way to approach it).

However you do it, your people or HR team will need to get buy-in from your finance department to fund employee travel before announcing this benefit. Some companies start with a small vacation stipend to allow the opportunity to review the benefit before investing in it more heavily. Working up to a more robust benefit is generally the preferred approach rather than starting with a larger travel stipend amount and having to dial it back due to budget issues.

Check out our free eBook that shows exactly why employee stipends are the best way to offer inclusive benefits that fit every budget.

Because the Internal Revenue Service (IRS) does not consider travel stipends regular income, it does not require employers to withhold tax (federal tax, social security tax, or Medicare). This rule has long applied to travel stipends for business purposes. Although personal travel stipends for employees are a newer development, the current IRS policy also applies to this benefit.

If stipend taxability is of interest to you, check out this helpful resource: Which Fringe Benefits are Taxable and Nontaxable?

A CNN Money report about companies who pay for vacation days highlighted several top companies that offer personal travel stipends and software company FullContact offered the most generous employee travel stipend at $7,500 per year.

Other examples of employee travel stipend programs:

Or, if you're more familiar with a vendor-based approach and need more information, here is a helpful Perks Vendor Cost Calculator to see what a difference going vendorless makes.

Compt can help you create a stipend program that your employees will love.