Whether or not employees qualify for help at the state level, employers can support their adoptive families by providing adoption assistance benefits.

What are adoption assistance benefits?

Adoption assistance benefits are employer-sponsored financial benefits designed to offset the costs associated with adoption.

Under an assistance program, qualified adoption expenses could include:

- Legal fees

- Home studies

- Counseling services

- Travel expenses

- Leave of absences

Some employees might qualify for their state's adoption assistance program (also called an adoption subsidy). Whether or not this is the case (it often isn't), employers can bridge the gap between what their state offers and what's needed.

Adoption leave vs. parental leave

Under the Family Medical Leave Act (FMLA), all public agencies and private organizations with 50+ employees must provide 12 full weeks of parental leave (unpaid). That includes adoptive parents.

Unpaid leave begins when the parents legally finalize their adoption. It does not cover the time new parents spend traveling to adopt a child. Since finalization typically happens several months after adoptive parents receive placement, the critical bonding period with their new child also takes place long before they're eligible for FMLA parental leave.

So, doing the legal bare minimum is rarely enough. Parental leave is one of the most essential employee benefits you can provide.

In many ways, your parental leave policy will look quite similar for biological and adoptive parents. But there are key differences, and your policy needs to reflect those.

Employer-funded adoption assistance policies typically include:

- Stipends and/or reimbursement for costs related to the adoption process (e.g., attorney fees)

- Paid leave for parents to take time off to meet with lawyers, do home visits and court appearances, etc.

- Flexible work schedules or phased leave so adoptive parents can spend quality time with their children

- Additional paid or unpaid leave beyond the FMLA-required 12 weeks (typically between one week and six months)

Most employers couple adoption with ongoing childcare benefits, which are meant to cover the everyday costs of raising a new child.

Why offer employees adoption assistance?

The simplest motivation for including adoption benefits in your benefits package is that it's the right thing to do. Caring about your employees means caring about their families and children as well. You should show that same level of support regardless of how they choose to start their families.

Aside from the moral implications, there are numerous reasons to offer adoption benefits:

- Assistance beyond laws and government programs. Your employees will have to meet several special conditions to qualify for their state's adoption assistance program, including whether they adopt an eligible child. And, while it's good the FMLA includes adoptive parents, it doesn't account for the unique timeline of adoption.

- Inclusivity. Adoption assistance is an inclusive benefit. Paid maternal leave (which is what most companies offer) is certainly meaningful, but it's exclusive to female employees who raise a biological family.

- Low cost. An estimated 0.1% of employees will actually need to use your adoption benefits. Mathematically speaking, you'll hardly even need to adjust your budget to include them.

- Strengthened employee/employer relationship. Alienating certain team members (such as an adoptive parent) inherently damages your company culture. Equal access to benefits for all employees leads to improved job satisfaction, trust in management, collaboration, and, by extension, investment in your company.

- Social benefits. The foster care system is severely underfunded. There are nearly 400,000 children in foster care at any given time. And every year, 20,000-or-so have their eighteenth birthday before ever finding a home. For your employee and their adopted child, your support could be life-changing.

Different types of adoption

Before offering adoption assistance, you should understand the total cost of adopting a child and what kind of situation your employee is in.

There are different ways to adopt a child, so benefits vary depending on your employee's level of needs.

Domestic adoption

Domestic adoption happens through private providers, such as adoption attorneys, agencies, or domestic adoption centers. It accounts for 38% of all adoptions in the United States.

The Children's Bureau estimates the cost of a domestic adoption to be between $30,000 and $45,000, though this varies wildly depending on the situation.

Costs include:

- Legal fees

- Court documentation

- Home studies

- Counseling

- Medical expenses

- Training for new parents

- Interim child care

Parents typically spend nearly $10,000 on legal expenses, court documentation, and home studies alone.

Foster care adoption

Foster care adoption takes place in the Child Welfare System. 37% of all adoptions in the US are through this system.

To adopt a foster child, parents must be approved by the court. They may choose to foster with intent to adopt, or they might already be approved to adopt the child before placing him/her in their home.

Foster care adoption costs vary from state to state, and some agencies/facilities use a sliding scale based on the adoptive parent's income. However, it's typically much cheaper than domestic adoption or private arrangements. On average, it costs $1,500.

Since there are many children in foster care with disabilities or special needs, this may be another consideration for your employees. Even though foster adoption is comparatively low-cost, it may require immediate medical expenses directly related to the child's condition.

International adoption

International adoption happens around the world through agencies in an adopted child's home country. It accounts for 25% of all adoptions in the US.

Adopting an international child requires more legwork and costs more than domestic adoption.

The process includes:

- Country application fees

- Agency/facilitator fees

- Immigration filing

- Travel expenses (visa, flight tickets, lodging)

International adoption typically costs up to $66,000. This varies depending on the child's country of origin — certain countries have more difficult immigration laws for US citizens and vice versa.

How to offer adoption assistance in the workplace

With a good understanding of what your employee might spend to adopt their child and the work they have to go through to do so, you're ready to create an adoption assistance program that best fits your company's budget and employees' needs.

1. Set up financial assistance and reimbursements.

Most companies cover expenses directly related to the adoption process.

There are a few ways they offer them:

- Reimbursement in part or in full for qualified expenses

- A family stipend that could be used for non-reimbursed expenses

- A predetermined percentage of total adoption expenses

- Capped reimbursement at a certain dollar amount

As far as which expenses qualify, the list is pretty straightforward. Most employers limit them to nonrecurring adoption expenses, such as:

- Application fees

- Court costs

- Home studies

- Living expenses

- Legal and administrative services

- Agency/facilitator fees

- Social worker/counselor fees

Some employers also consider travel (e.g., airfare, lodging) to be a qualified adoption expense since it's required for many adoptions.

Regarding the amount you might cover as an employer, the typical ceiling is about $4,000. According to data from the Child Welfare Information Gateway, companies that offered adoption assistance averaged $3,879 in reimbursement for qualified adoption expenses.

While companies offer reimbursement once the adoption is legally finalized, this isn't very helpful to the employee. Again, it typically takes six to 12 months after child placement to finalize the process. And your employees will incur most of their expenses while they're sorting things with the birth parent or attorneys.

For these reasons, it's a better idea to offer stages of reimbursement before the child is actually placed. That way, you can help your employees offset their large upfront legal costs.

Using the average ($4,000) as a hypothetical price ceiling for your adoption assistance program, here's an idea of what that might look like:

- $1,000 reimbursement upon completing the application and filing it with the respective adoption agency

- $1,000 reimbursement after completing the home study

- $2,000 reimbursement after legally placing the child in your employee's home

2. Plan for taxes.

Per IRS Publication 15-B (Employer's Guide to Fringe Benefits), reimbursement for adoption expenses is not subject to federal income tax. It is, however, subject to Social Security, Medicare, and federal unemployment tax.

All you have to do is deduct your reimbursements for adoption expenses the same way you'd deduct other benefits. Offering adoption assistance does not qualify you (the employer) for any special tax credits.

Your employee, however, may utilize tax credits for qualified adoption expenses. Through the Adoption Tax Credit, adoptive parents can claim up to $15,950 (2023) in credit per child. This is a tax credit, so it reduces the amount of taxes owed rather than offering a reimbursement.

Your adoptive parents are able to use both a credit and income exclusion when they adopt, but they can't use them for the same expenses. They can only use them for expenses you don't reimburse.

3. Decide on parental leave policies for adoptive parents.

Before launching your adoption assistance program, you have to get the logistics sorted. That means incorporating adoptive parents into your company's parental leave policy.

Here's a list of questions to ask when ironing out the technicalities:

- Who is eligible? Most employers extend adoption benefits to full-time W2 employees only, though some extend this to part-time workers as well. Some eligibility requirements will be mandated by state and federal laws. Others are entirely up to you.

- What does the application process look like? To determine who is eligible (based on your criteria), you also need to create a system for applying for benefits.

- How will employees request a leave of absence? Since adoption follows a considerably different (and somewhat less predictable) timeline than childbirth, you should be more flexible about how and when soon-to-be adoptive parents can take leave.

- How much unpaid leave will adoptive parents get? FMLA requires employers to offer 12 weeks of leave after finalizing a legal adoption, but you may want to be more generous with your policy. This includes job security while on leave.

- How much paid leave will I offer? Competitive employers offer paid leave. Bottom line. The amount of time you offer is up to you. For reference, the average paid maternity leave companies offer is 8 weeks.

4. Determine eligibility.

Besides determining eligible faculty, you'll run into a few challenges when creating your adoption assistance program.

- Your employees' access to adoption assistance might be effective as soon as you hire them, or you may wait for a period of time before they're eligible for their full benefits package.

- If an employee adopted within the last year or is currently going through the adoption process, you have to determine whether they will be retroactively eligible.

- You may or may not include stepparent adoptions in your policy, since they don't require the same leaves of absence and associated costs as other types of adoption (except in the case of same-sex adoptions, which do require additional steps).

- You may or may not include kinship/relative adoptions, which, despite happening within the same family, still require time for the adopted child to adjust to their new caretaker.

5. Create an adoption-friendly company culture.

You might already be familiar with the needs of traditional birth parents. Taking the time to learn the needs of adoptive parents and their families is equally important, and it helps you provide for them appropriately.

To support adoptive parents, here are a few enactments you can make companywide:

- Offer an employee assistance program (EAP) that includes adoption

- Make your overall work schedule and PTO policy more flexible to support potential needs for adoption-related leave (among other employee needs)

- Celebrate adoptive parents just like you would new biological parents.

Adoption-friendliness goes both ways, too. Let's say an employee plans to place her child for adoption after giving birth. She will still need time to physically and emotionally recover afterward, so you should still regard her for leave eligibility.

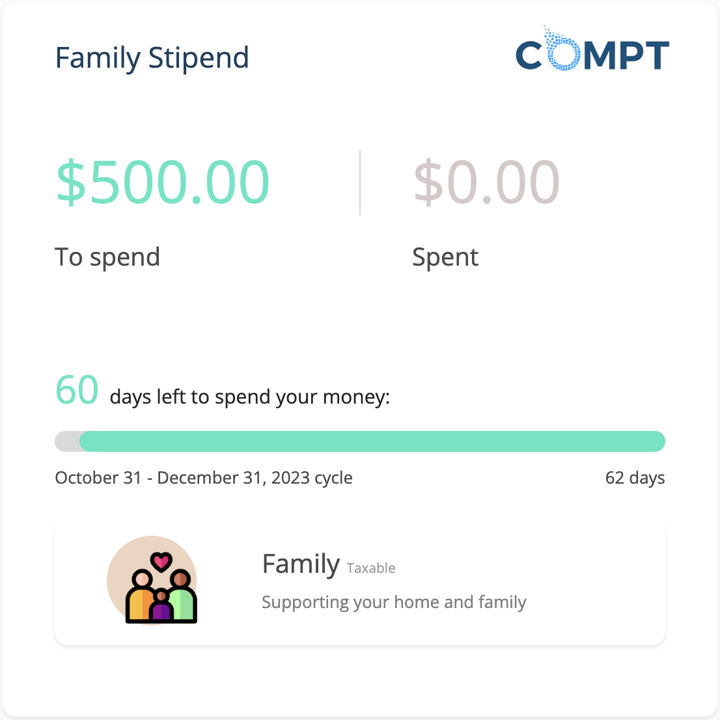

Offer a family stipend with Compt

Providing a reimbursement or stipend is one thing. Properly accounting for it is an entirely different matter.

Managing eligibility and tax compliance is extremely difficult if you're managing it without software (especially considering adoption assistance is just one small benefit among many).

With Compt, you can create a custom family stipend that employees can use for adoption-related expenses.

All you have to do is set the rules from your policy, add your employees, and let our platform do the rest of the work. Whenever an employee submits a reimbursement or qualifies for a stipend, you can release the payment with a few clicks.