Offering traditional one-size-fits-all benefits is so 2010.

Most organizations today offer employees traditional benefits like health insurance and a 401k.

When everyone wants something different, how do you satisfy them? all?

The process of purchasing benefits hasn’t evolved since perks first emerged, and so HR team members have to be involved in picking, piloting, purchasing, managing, and maintaining a bunch of individual perks and vendor relationships. And that's on top of everything else they have to do!

Traditional benefits don't solve for every single employee, like those working hybrid or remote. Employees without access to flexibility are 2x as likely to report dissatisfaction at work and half say they would leave their company if offered a more flexible alternative.

Because benefits are often hand-selected by the organization they, unfortunately, end up being generic in nature. You can only bring in so many vendors, meaning the perks are often not what people would purchase given the money or funds themselves.

If a workplace environment doesn't fit with the conditions where an employee's brain can thrive, companies probably won't hold on to their best employees for long. While cash compensation matters in employees’ lives, it’s not all that matters.

Rewards that signal to employees that they did a good job and that their manager cares about them will encourage employees to want to work even harder. There is significant research showing that retaining employees aligns with tapping into three strong psychological needs: the need for autonomy, the need to show competence, and the feeling of a sense of belonging.

Monetary compensation does not satisfy these needs, and thus employees need a way to feel motivated, engaged, and committed to their workplace.

In most organizations, there are no perks programs that solve the needs of every single employee in a way that is meaningful to them.

Creating a personalized program doesn’t have to be difficult to do. Even just a little innovation gives you a competitive advantage. So what’s the secret? How does a company personalize its employee benefits?

A Lifestyle Spending Account is an employer-created and contributed account for employees. They put the perk money in the hands of employees, so they can get the perks they want and need most.

Interested and want to learn more about LSAs? Click here to read our definitive guide on Lifestyle Spending Accounts and stay ahead of the trend.

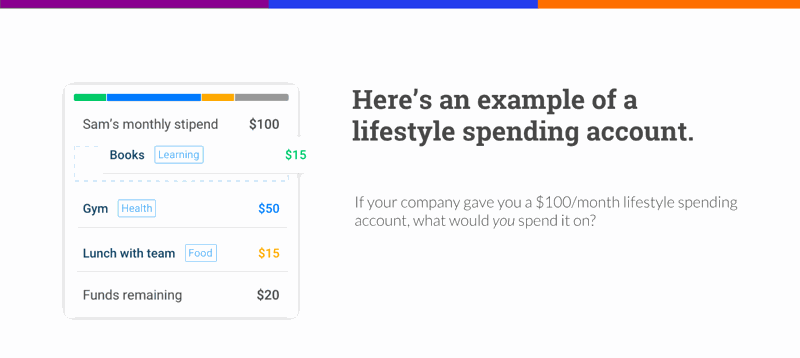

In the example below, Sam's company has allocated $100 per month for her and other employees to spend in the following categories: continuous learning, health & wellness, and food:

This month, Sam purchased books, a gym membership, paid for lunch with her team, and still has $20 remaining. Using a Lifestyle Spending Account, Sam is able to purchase the perks that are most meaningful to her life.

Sam now knows that her company encourages her to learn continuously, follow a healthy lifestyle, and nurture meaningful connections, which can have a tremendous impact on her loyalty, engagement, and satisfaction with her current workplace.

Setting up a traditional perk program from scratch takes a series of steps and many months to do it right. A personalized stipend program like Lifestyle Spending Accounts (LSA) is a much easier process that results in happier employees.

1) Identify your current and future EOY number of employees, and your total budget.

2) Determine how much you'd like to spend per employee per timeframe. Timeframes could be monthly, quarterly, semi-annually, annually, or a one-time basis.

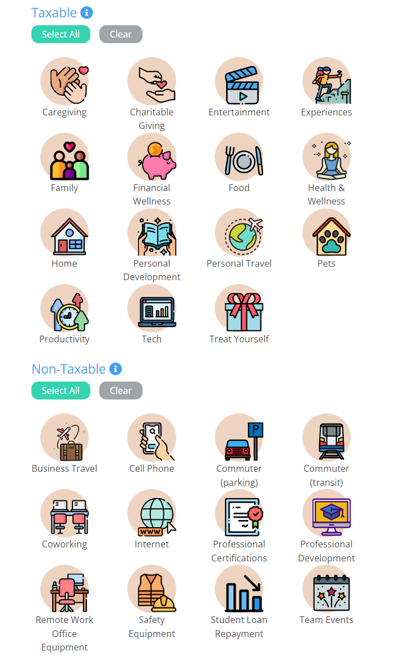

3) Select categories for employees to spend in. These could align with the company mission, values, and goals, or be 100% open to give employees complete freedom over their perks. Some popular categories include health & wellness, continuous learning, family, food, and travel.

4) Set up your program. If you use a perk management software like Compt, this could take 15 minutes. If you're doing it manually - develop a spreadsheet/form where you can manually track the individual perk expenses, total amounts remaining within each time frame, collect receipts, account for taxes, data for finance, and the status of each perk expense.

5) Last, but not least, communicate it to the team. Draft up an email, or better yet, a page on your internal wiki to communicate the new perks plan you have implemented. Remember to explain the why, what, when, and how details. Lastly, supercharge your communication plan by creating a forum for people to provide feedback, whether it's a form for them to complete or holding a series of office hours.

When companies use Lifestyle Spending Accounts, they experience the following benefits:

Back in 2010:

Perks, when they first emerged over a decade ago, were considered “nice-to-haves” and employees’ expectations for them were low. Companies offered things that we today consider “fluffy” like snacks, free beer, ping pong tables, and massages. Also, because perks were considered a bonus by employees, there weren’t any formal processes or programs around them. There was often free beer in the fridge and snacks lying around, but it wasn’t a big deal when there weren’t.

Today in 2023:

However, fast forward to today. The adoption of perks is growing, but the models of offering them haven’t kept up. Unlike many other industries, perks do not yet have any frameworks or processes defined for how to pick perks for a company. Most people are relying on prior knowledge, experience, and that of others.

Perks have transitioned into a “must-have” for every company as expectations are higher than ever. Employees are looking further than free snacks and demanding more meaningful perks, such as workplace flexibility, wellness, student loan forgiveness, childcare, and continuous education. Perks are now a critical talent strategy that is becoming increasingly expensive.

Just think about how needs and preferences differ between generations, life stages, locations (remote vs in-office), health & wellness needs, etc.

Personalized perks offer diverse organizations the chance to better engage their employees and make them feel appreciated in the workplace.

Join the revolution to ensure your company attracts, engages, and retains top talent. Gain all the benefits of offering hyper-personalized, flexible, and inclusive benefits with none of the added complexity and all of the tax compliance.