Every year people come to us at Compt and ask...

“What is the difference between personalizing perks with debit cards vs employee stipends (or reimbursements)?"

It’s an excellent question.

We understand the need to know the difference as:

- The need for personalized and flexible employee perks is higher than ever now, with the rise of remote and hybrid work, as well as the focus on employee wellness.

- It is a choice that most HR professionals are going to have to live with for quite some time, as rolling out compensation-based tools to your team is no easy undertaking.

At Compt, we only build software that helps companies set up, manage, and scale their perk stipends...but the truth of the matter is that a debit card model might be suited to your team's preferences. And we're okay with that!

This article is going to explain the pros and cons of each, debit card and lifestyle spending accounts, in an honest and transparent manner. This way, by the end, you’ll be able to identify which is the best for you and your organization. Whichever approach you take, you'll be offering much-needed support to your employees - and that's something we'll always root for!

Employee Perks with a Debit Card vs. Lifestyle Spending Accounts (a.k.a. stipends)

Let's start with everything you need to know about offering employee perks through a debit card model.

Employee Debit Cards: An Overview

A list of Debit Card Vendors

Pros of cards for employee perks

No receipts

With a debit card, because all purchases are made through the company-provided card, no receipts are required for reimbursement.

Cool-factor

Some employees crave status with others, especially their peers, and a company credit card can look like a status symbol. The optics of cards can be really cool, especially when used at stores in front of their friends or family.

Potentially unlimited options for spending

If the debit card you choose allows for no restrictions, employees can use them on expenses they want when they want. If they can walk into any restaurant and buy their lunch on the company, or any clothing store they walk by, that’s pretty cool. It allows for spending in the moment of need, which is where a debit card truly shines. However, if this on-the-spot spending matters to you, make sure you’re choosing a debit card that allows for 100% open-ended spending anywhere. Many of the debit cards available must be used for a particular set of vendors available on their platform, or only where VISA's are accepted, and / or with other restrictions that pertain to employee spending on a physical or virtual card, so keep that in mind!

Cons of cards for employee perks

CON (for your business): Cards require accounts to be prefunded, a.k.a. frontloaded

Debit cards require that you pre-fund them so that the team has funds available when they go to make a purchase. Typical usage rates of debit cards are 15-20%, but you are locking up your cash for 100% usage for that period. If a company offers $100/month to its 1,000-person company, this means that you are essentially allocating and locking up $1.2M, rather than paying for items as they are purchased (and leaving the rest alone!). This could cause some serious heartburn for a finance team.

CON (for your business): More costly to manage

Card costs are typically higher because you are paying for the hardware of the card (if you're offering a physical card), as well as the cost of the software, resulting in higher rates per employee as well as additional card-related fees.

CON (for your employees): Difficult to spend the amount given

Because funds are loaded into their card (like they would be in a traditional gift card) those last few dollars are always tricky for employees to spend. What happens when there are just a few dollars left? Employees are left with the burden of hunting down a right-size purchase so that they can 1) spend the exact right amount, or 2) pay enough on the card and split the cost using another payment method (if the vendor allows that!). They would then have to go through this every time they reached the end of a spending allotment.

"We do $50 per month per person, and I always end up with about $6 left, and I can never find anything to buy for those prices." - G2 review

CON: Choice is limited by vendors included on the platform

Since most of these models are vendor-based, your people are limited to select from the pre-determined vendor list curated by the platform. This means that often, your people likely cannot buy takeout at a local restaurant, drive-in movie passes, or a spur of the moment ice-cream treat for the family if their vendor of choice isn't on the list.

Here are a couple of reviews that showcase this dilemma, from Zestful (a card vendor) customers:

"I wish there was an app so that when I am in a restaurant and I wonder "Is this place on my zestful card?" I can check quickly instead of having to type my login info into the mobile site every time and then find the catalog and search for the restaurant. This process takes more than a couple minutes and usually I don't have enough time before I order." - G2 review

"One time I submitted a new business request for a store that had a great sale. Unfortunately the process took longer than several days, at which point the sale had ended." - G2 review

"An authorized retailer allowed me to buy online, but I was rejected in the brick and mortar store." - G2 review

CON (for your business): All purchases are approved, regardless of what is purchased

Since people purchase perks in the moment, everything is approved regardless of what they spend their money on, which means no ability to reject purchases and limited controls for the company. If you are trying to align your perks with your culture, this can be a challenge, however, this can also be a pro if you don't care what your team is using this perk money on.

CON (for your business): Not scalable for larger organizations

Depending on how many employees you have, setting up and replacing cards can be a burdensome task.

CON (for your business): Potentially not compliant with IRS tax law

Unless cards are limited to commuter benefits (up to IRS limits), continuous learning, or cell phone reimbursement, it is nearly impossible to have these perks be tax compliant. Most items that an employee would purchase require both employer and employee payroll taxes to be applied. If an employee is making personal purchases on a debit card, it is nearly impossible to track what items they should be taxed on. And since this does not automatically run through payroll, there would have to be a separate tracking and payroll processing procedure to ensure that employees were paying their taxes correctly. This is not part of the debit card process and would have to be a separate tracking within the finance and HR team.

Other questions to ask when evaluating debit/credit card perk softwares:

The following are some other questions which have come up for us in conversations, but we’re not sure as to the answer:

- What happens to the debit card and the remaining balance when an employee is terminated or leaves the company?

- What happens if they are purchasing something and do not have enough money on the card to cover it? It an be tough trying to spend the final dollars or cents on a card in a meaningful way.

- Do people really want another card in their wallet? Everyone from Uber to Apple now has credit cards available and most people aren't trying to add cards but remove them.

- Can people get points on these debit cards like they can with using their credit cards?

- What happens if a debit card is lost/stolen and someone other than the employee spends the balance. The money is gone, but do employees get a new card with their remaining balance set up? How will a company account for the additional expenses?

- Are multiple stipends possible (e.g., one for health & wellness and continuous learning), and how does the debit card know which category to apply the spending to?

- If there is spending on pre-selected vendors, how is their approach different from using gift cards?

Employee Stipends: An Overview

Note: The information below is related to the lifestyle spending account approach using the Compt software as it is currently the only perk management software using reimbursements.

A list of Perk Stipend Vendors (with Reimbursement)

Pros of stipends or reimbursement for perks

Unlimited options for spending

Because team members are buying what they want and submitting an expense, their options for purchasing are unlimited. From Spotify to daycare costs, student loan repayments, individual pet insurance providers, and more, they can buy the perks most relevant to them and their always-evolving needs while spending in categories predefined by you.

You only pay for what gets used; the rest is kept in the business

Because Lifestyle Spending Accounts reimburse employees after the money is spent, there are no funds sitting in another bank account that you can’t access. Plus, since you only pay for what gets used (a use-it or lose-it approach), you’re always at or under the budget.

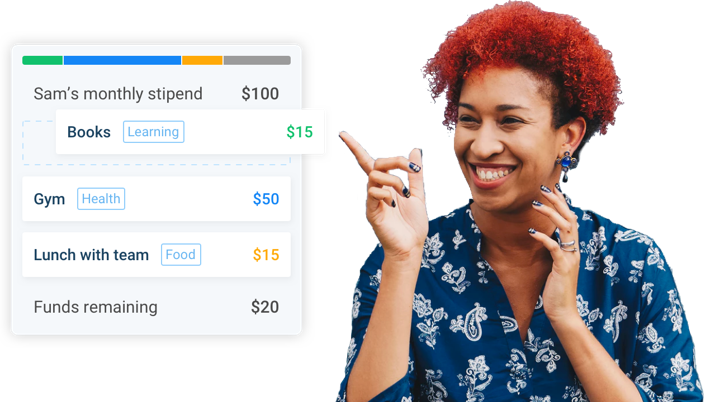

Here’s an example of what this looks like in practice:

You give your employees $300/quarter to spend on health & wellness. An employee spends $250 during the quarter and uploads their receipts. On the first day of the new quarter, they receive a new $300, but the balance remaining from the prior quarter is no longer available. As a company, this ensures that you always know your maximum cash exposure, but also keep all of those funds in your bank account until it is time to run payroll for your team. None of your funds are ever held by Compt.

Reimbursement model

There is a reason the reimbursement model is still the most popular method for benefits management. It’s because the reimbursement process:

- only takes a few minutes for employees

- provides HR with a wealth of information they need related to viewing, approving or rejecting purchases

- ensure 100% tax compliance (which is a built-in feature with Compt)

- and it’s also how true personalization is possible because there are no limiting vendors or catalog for people to sift through.

Related to the last item, not everyone uses the same gyms, tv-streaming services, mental health apps (there are over 10,000 in the Apple store), and reimbursement allows people to pick the vendors they want and need without them being needing to pre-approved by som vendor marketplace.

Expenses can be reviewed before being approved

If a purchased perk does not fit within perk spending guidelines, they can be rejected and no further work is required on your end.

(You don't have this option if you offer a prefunded card. That means you're sitting on a huge potential for misuse of funds across all of your employees using a card model - whether it's intentional or not!).

Set-up multiple stipends at once

The goal with lifestyle spending accounts is to create one or more stipend that align with your company’s mission, vision, values, and goals. For example, set up a one-category stipend that aligns to specific goals like “health and wellness.” Or align a stipend to a cultural value at your organization, like an “Always be learning” stipend, or develop a general stipend like “Treat yo-self” (this is a real stipend name from a customer of ours) where multiple spending categories are offered.

You don't have the means or ability to do this with the employee card model; your employees just have the one card and everything they spend on falls into it.

Member grouping settings

You can create groups of members based on location, job function, awards they’ve won (like President’s Club), or anything else. With these groups, you can create specific stipends like a “Remote employee” stipend or a “new hire tech” stipend so that you created an automated process for supporting people wherever they are in their employee lifecycle, or their location, career-journey.

100% tax compliant

This is a big one that the employee card model overlooks. With perk stipends, team members must select categories when uploading their perk receipts, which makes them 100% tax compliant on the backend when it's time for your team to do the paperwork. With the Compt functionality, not only are your perks always 100% tax compliant, but you can decide between who pays the taxes (e.g., the company grossing up vs. the employee).

Cons of stipends or reimbursement for perks

CON: Receipts and the reimbursement process

While the reimbursement model is a PRO, it can also be considered a con because it does take a few minutes per employee to upload their perk receipts and some companies would love to avoid asking their employees to do that.

Key Takeways

As shown above, there are clear upsides to offering employee lifestyle perks through the debit card model and through a stipend model - both approaches help you better support your employees in a more personalized way than traditional perk programs.

However, it's clear that choosing a debit card option (especially for the sole reason of avoiding receipts) typically costs you more in the end.

These are the biggest drawbacks you'd face when opting for a employee debit card model for perks:

- No employee receipts = huge headache and potential IRS troubles when it's time to do taxes (many companies come to us after realizing this a bit too late). You'll need to manually calculate who is using what and track utilization for tax purposes.

- When using a card model, you lack of visibility into and understanding of your employees' spending, and therefore increase the potential for employees to misuse funds

- You'll typically have a limited vendor list, which is a big blocker when it comes to supporting small or local businesses and unique categories

- You'll have no ability to fully support a dispersed or international team

Considering a new approach to perks?

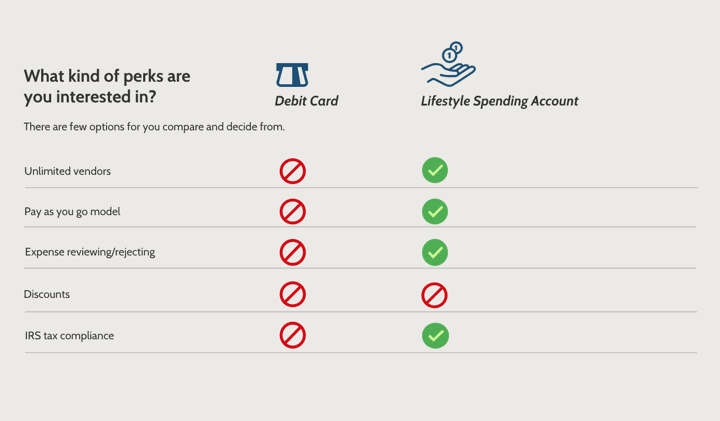

Whether it's selecting a debit card/gift card option, vendor marketplace, discount platform, or Compt -- our goal is to help you choose the best perks program for your situation. That's why we've created this helpful comparison graphic.

Click here to download the Perks Approach Comparison Graphic

Compt is the #1 employee stipends platform that gives your people the freedom to choose the lifestyle perks that are best for them and their always evolving needs, even when remote. Interested in learning how Compt might benefit your company? Consult with our team or request a demo.