There's no way around it: the work commute is a frustrating way to start (and finish) the day, especially if your office is in a huge metro area like LA, SF, or Boston.

Besides sitting in the car for 30+ minutes every time, there's something odd about employees having to pay to go to work.

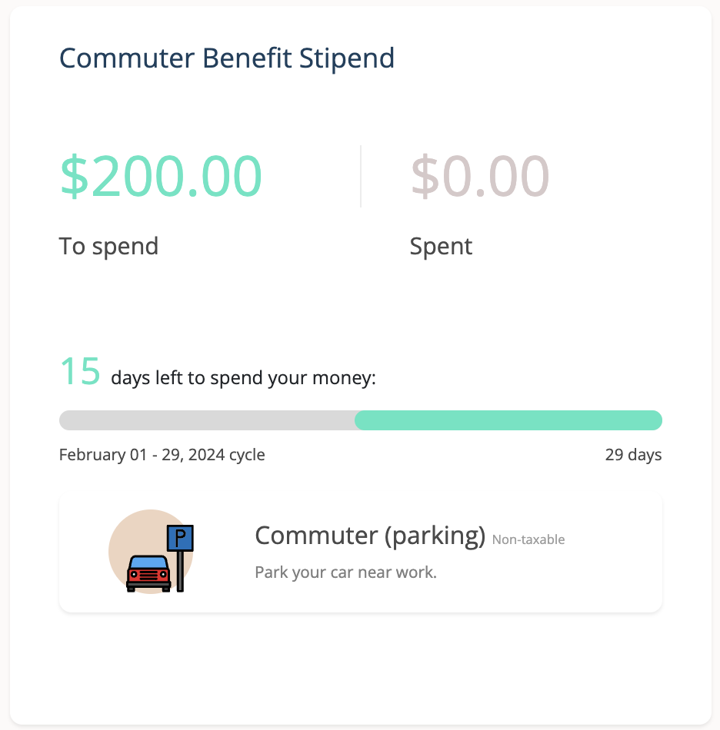

Parking reimbursement is a low-cost benefit that's easy to set up. And it benefits your employees — you can exclude reimbursements from their wages (up to a certain amount).

What is parking reimbursement?

Parking reimbursement is a fringe benefit where employers pay back their employees for work-related parking expenses on a tax-free basis. Employees pay upfront for qualified expenses, submit a claim form, then receive the repayment through payroll.

Eligible expenses include:

- Parking fees, such as daily or monthly costs at a designated lot or garage

- Metered or timed parking on the street

- Parking expenses incurred while traveling for work

- Expenses for parking at a job site away from the employee's regular workplace

You can offer parking reimbursement as a standalone benefit, but most companies include it as part of a more comprehensive commuter benefits package.

How parking reimbursement works

Aside from the tax-related technicalities (more on that next), parking reimbursement is quite simple.

- Set an upper limit, or a per-month/reimbursement cycle cap.

- Create an enrollment form.

- Employees submit claims for their parking expenses (receipts, proof of payment, etc.) to HR.

- HR processes each claim.

- They disburse the funds through payroll (direct deposit).

With a stipend platform, it's easy to manage (and, in some ways, automate) the process.

Why offer parking reimbursement as a benefit?

Well, for starters: the money.

Bankrate analyzed Americans' average commuting costs, and published the data in a recent article. They found the typical American spends $8,466 per year on their daily commute (~19% of their annual income, on average).

While some of that obviously goes toward gas and vehicle maintenance, parking fees are a not-insignificant part of the equation. Depending on your office's location, you could be looking at anywhere from $150-$300 per month or well over $300 in high-cost-of-living cities like San Francisco.

Allowing your team to work on a hybrid model doesn't even help much. Day parking in most cities is quite expensive, so they're still better off paying monthly for parking.

It helps with a return to the office. Many companies are asking employees to return to the office after working remotely during the pandemic. By offering parking reimbursement, parking becomes one less cost employees have to worry about.

It's also good for employee retention. Many see commuting as a tremendous inconvenience. Cost is a big contributor to that. It's part of why 94% of workers say they want more flexibility in how/where they work.

It might be required by law. Certain states and cities have requirements regarding offering commuter benefits to employees that work in those municipalities. Currently this list includes; NYC, New Jersey, Philadelphia, Washington DC, Seattle, Los Angeles, Bay Area, San Francisco, Richmond and Berkeley, CA. This list is subject to change, so ensure you review the regulations in the areas your employees are located.That means not offering this benefit can be a deal-breaker for your employees. Getting sick and tired of paying for parking might be the final push someone needs to say "Yes" to that remote job offer or start replying to the recruiters flooding their LinkedIn DMs.

Employee tax implications of parking reimbursement

Parking reimbursement is considered a Qualified Transportation Fringe Benefit (QTF for short).

According to IRS 2024 Publication 15-B, the monthly exclusion limit for qualified parking is $315, an increase from the previous year's $300. This means employers can exclude the covered cost of parking up to $315 per month per employee from their gross income, and it is not considered taxable income for the employee.

If the value of a qualified parking benefit received in any month is more than the limit, the excess amount must be included in the employee's wages, minus any amount the employee paid for the benefit. The excess is subject to FITW, FICA tax and FUTA tax.

There is also a monthly exclusion of $315 that applies to mass transit passes and commuter highway vehicle transportation. These two limits are separate and can only be used for their respective purposes.

You can use Compt to manage all your reimbursements, including employee parking and other commuter benefits. It's 100% tax-compliant, so you can spare your back office the headache. See how it works.