HR leaders are turning to fringe benefits to make their team's commute to work a little brighter, even if it's for only a few days a week.

But after three years of many employees being allowed to work from the comfort of their home, perhaps for the first time in their career, returning to the office can be a tough sell. After all, Americans, on average, spend nearly an hour (53.6 minutes) traveling to and from work each day, according to U.S. Census Bureau data. That commute costs Americans, on average, $8,466 each year - about 19% of their annual income - according to Clever Real Estate.

However, HR leaders can ease that burden by implementing a commuter benefits program.

In this post, we'll cover:

- What are Commuter Benefits?

- How Commuter Benefits Work

- Types of Commuter Benefits

- Why You Should Offer Commuter Benefits

- How to Implement a Commuter Benefits Program

What are Commuter Benefits?

Commuter benefits are employee perks that offset or reduce transit and parking expenses for getting to and from work. For nearly 40 years, companies have been able to help pay commuting costs thanks to the Tax Reform Act of 1984, according to Pace Law Review. Although these benefits aren't mandated by the federal government, several cities have passed laws that require employers with a certain number of employees to offer commuter benefit programs on a pre-tax basis.

- Philadelphia's ordinance applies to companies with 50 or more employees who worked an average of 30 or more hours a week for the past 12 months

- The San Francisco Bay Area also requires companies with 50 or more full-time employees to offer such benefits

- Ordinances for Washington, D.C., New York City, and Seattle apply to companies with 20 or more full-time employees

- New Jersey is the only state to enact such legislation, which applies to all companies that employ at least 20 or more employees

Employers in many cities without those laws also offer commuter benefits to help cover the cost of parking expenses, public transportation expenses, and other commuter expenses. Nearly one-third (31%) of HR leaders and C-suite executives in the U.S. planned to either introduce or expand commuting benefits in the near future, according to a 2021 survey by Care.com.

As the RTO tug-of-war between companies and workers continues, that percentage has probably risen in the two years since then.

How Commuter Benefits Work

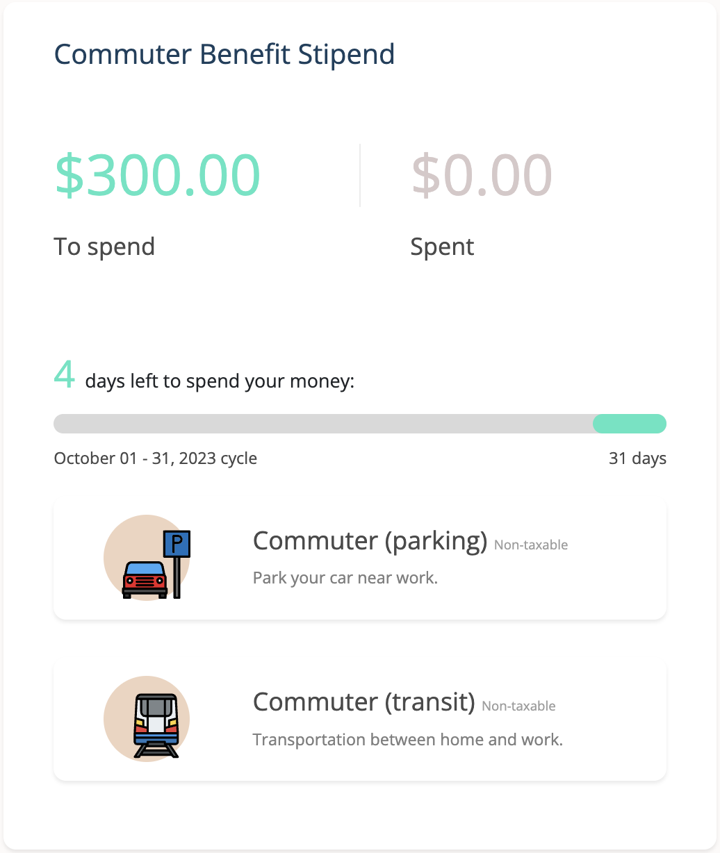

As of 2023, the Internal Revenue Service (IRS) allows employers to withhold up to $300 per month for pre-tax commuter benefits, such as qualified parking, commuter highway vehicle transportation and transit passes.

Employees can access their pre-tax money through various payment options, such as a benefits debit card, voucher or pre-paid transit passes. For example, one swipe of the benefits debit card, and employees cover their bus fare, ferry tickets, transit passes, parking permits, etc. Employees also have the option to pay out of pocket and then file a claim for reimbursement.

When it comes to savings, commuter benefits are a win-win for companies and their talent. Not only are payroll taxes reduced for businesses, but workers don't have to pay income tax on the deduction from their salary. It's an easy, effective way for all parties to save.

But what if one of your team members calls out sick for the week and doesn't have to make the trek to the office? Will their pre-tax contributions have gone to waste? Nope. The funds will still be there for when they need them.

Let's say your company operates on a hybrid work schedule. By not coming into the office five days a week, some employees may worry they're not getting as much bang for their buck from their commuter benefit. That's no problem because, in most cases, the money carries over month to month and year to year.

The only way that employees won't be able to access the money is if they're terminated, laid off or voluntarily leave the company. The IRS doesn't allow employers to return unused funds from commuter benefit programs to employees.

Types of Commuter Benefits

Commuter benefits fall under two categories: pre-tax and after-tax.

The former means that these benefits are funded by employees' pre-tax dollars. According to the IRS, these transportation benefits include fully or partially covering:

- Parking expenses, such as fees for using parking lots, parking garages, and parking meters

- Public transit expenses, including riding the bus, ferry, train, subway, and trolley

- Van pooling, in which there's seating capacity for at least six adults (excluding the driver) and for which at least 80% of the vehicle's annual mileage is for transporting employees to and from work

The latter is when companies pay for transit and parking expenses that exceed pre-tax contribution limits. These transportation benefits include:

- Gas stipends

- Toll reimbursement

- Flexibility to work from home

- Carpool system

- Monthly stipend for Uber, Lyft or other ride-sharing apps

- Annual stipend for vehicle maintenance

- Monthly stipend for bicycle repairs

Before 2018, employees who commuted by bike could be reimbursed with pre-tax dollars. Then, the Tax Cuts and Jobs Act (TCJA) removed bicycling from eligible transit benefits through 2025. The only glimmer of hope was the Bicycle Commuter Act of 2021, which would've repealed the TCJA's suspension, but the bill failed to gain any traction.

Why You Should Offer Commuter Benefits

It's no surprise that most people loathe commuting.

It's costly, time-consuming and oftentimes aggravating, especially if you get stuck in rush hour traffic or miss your train. As many as 40% of American workers have gone so far as to claim they'd rather be cleaning their toilet at home than commuting to the office, according to a RingCentral survey.

Although eliminating mass transit and parking headaches may be out of HR leaders' hands, they can still give their employees some much-needed relief. Commuter benefits funded by pre-tax dollars can improve employee morale and engagement by helping team members save money on commuting expenses. Your staff will appreciate not having to pay their own way to come to work, which can ultimately reduce employee turnover. And, as every HR leader can attest, it's much cheaper to keep someone than to recruit, onboard and train a new team member.

However, a commuter benefit can also enhance your talent acquisition strategy. Nearly two-thirds (64%) of employees cited "pay and benefits" as the most important factor in accepting a job offer, according to a 2022 Gallup poll. In this red hot labor market, offering parking benefits and assistance with transit expenses can be a difference maker. Let's face it, business leaders demanding in-office attendance without establishing a commuter program won't be able to compete in the war for talent.

Don't forget the tax benefits. With less taxable income to account for, employees will see higher tax savings and keep more money in their pocket. Meanwhile, employers can save up to 10% on Federal Insurance Contributions Act (FICA) and payroll taxes, according to Philadelphia city officials, who enacted an ordinance requiring commuter benefit programs starting this year.

In addition to the tax savings, a commuter program can reduce an organization's carbon footprint by promoting ride sharing and public transit rather than more cars on the road.

How to Implement a Commuter Benefits Program

If you're considering launching a commuter benefits program, here's a step-by-step guide for effective implementation.

1. Find out your team members' needs

As with any benefits program, HR leaders should gauge employee interest before investing time, energy and resources into its creation. Send out a pulse survey asking team members if they'd participate in such a program, what their current commute challenges are, and what solutions they'd prefer. For example, if most employees drive to work, it wouldn't be prudent to focus on public transportation expenses. Instead, parking benefits would be a popular addition to your offering.

2. Set your budget

After you learn how many team members will be participating and what types of benefits they find most desirable, it's time to crunch the numbers. While a commuter benefit program does provide tax savings for both employee and employer, you want to ensure it's fiscally feasible for your current needs. Of course, you want to maximize your benefits budget, but you have to perform due diligence before committing to such an endeavor.

3. Determine who's in charge

Managing this program can be a full-time job, and HR leaders are already overworked. Rather than adding yet another task to their plate, companies may want to rely upon an HR technology provider, such as Compt.

The 100% IRS-compliant reimbursement platform helps companies offer inclusive, personalized, and flexible compensation and benefits programs, including commuter benefits. Customers don't have to worry about trouble with their tax advisor, either, as Compt's software automatically limits employees to claim no more than the $300 maximum for transit and parking expenses.

4. Establish your policy

Your commuter benefits policy should include the eligible transit and parking expenses that can be covered or reimbursed; the IRS-mandated limits; and how team members can take advantage of these tax benefits either by using either a debit card, voucher, pre-paid transit passes or through reimbursement.

5. Promote and educate

Congratulations! Now that you've established your commuter benefits policy, it's time to roll out the program.

As with any new employee benefits program, clear and consistent communication is vital for a successful launch. Thus, HR should engage in an all-out media blitz: webinars, email blasts, intranet postings, posters around the office, fliers and pamphlets mailed to team members' homes, etc. During weekly meetings or check-ins, managers should also be encouraged to remind their direct reports about the program. If there's room in the budget, perhaps HR could even purchase promotional products, such as windshield scrapers or key chains, to hand out as a physical reminder of the launch.

As part of the benefits communications strategy, HR should inform employees when and how they can register for a commuter benefits account, as well as the accompanying tax benefits. You can't stress the savings enough. Be loud and proud that by enrolling in the program, team members will pay less and save more during their commute.

This isn't just for internal messaging - promote the commuter benefit externally, too. Announce the launch of the program on your company website and social media channels, emphasizing to customers, competitors, and potential applicants that you're fostering an employee-centric workplace. After all, company culture is more important than ever following the Great Resignation: 90% of workers who rate their culture as "poor" have thought about quitting, according to SHRM's 2022 Global Culture Research Report.

These employee perks are also a great weapon to have in your recruitment arsenal. If another company is requiring workers to come into the office without providing any assistance for commuter expenses, you instantly have a competitive advantage. Even if if you can't match that company's compensation, you may level the playing field when a candidate assesses the savings calculations by not having to pay as much for transit and parking expenses.

Final Thoughts

Giving compensation, health insurance and paid time off (PTO) simply isn't enough anymore. Look no further than "pay and benefits" being cited as the most common reason that workers quit their job in 2022, according to Gallup. Companies have to supply their talent with a comprehensive benefits package that supports workers' holistically. That means their time inside, outside, and for the purposes of this blog post, on the way to and from the office.

If you want to attract, engage and retain top talent, you have to provide commuter benefits, especially if you're trying to transition your workforce from remote work to an in-office environment. Whether your team members use public transportation or drive themselves to work, they'll truly value benefits that save their hard-earned dollars. It's not just a goodwill gesture, though, because the benefits will have a ripple effect throughout the company. By demonstrating how much you care about your team members, even when they're off the clock, productivity, morale, and retention will increase.

The commute may not be any shorter, but they'll be happier about the destination.

Interested in learning how Compt can help you administer commuter benefits in a tax-compliant manner? Click here to schedule a demo with our team.