We've all heard the horror stories—mountains of debt, ascending interest rates, and a seemingly endless cycle of loan payments that remind nearly 44 million borrowers that they indeed went to college.

Employers competing for the best college-educated talent need to remember that a lot of them are on the hook for thousands (or tens of thousands) of dollars in financial aid.

To help, top companies are offering student loan assistance as part of a comprehensive benefits package.

Student Loan Debt by the Numbers

According to data compiled by the Education Data Initiative:

- Student loan debt now totals $1.757 trillion across 43.8 million borrowers.

- The average student loan debt balance is $37,338.

- 20% of all American adults have some outstanding undergraduate debt.

- Adjusted for inflation, the average student now borrows 37.9% more than they did ten years ago.

Plenty of companies source entry-level talent directly from school job fairs, and recent grads account for about 16% of all entry-level new hires.

In addition to those who just graduated, millions of employees have been burdened by their student debt for years.

What is a student loan repayment program, exactly?

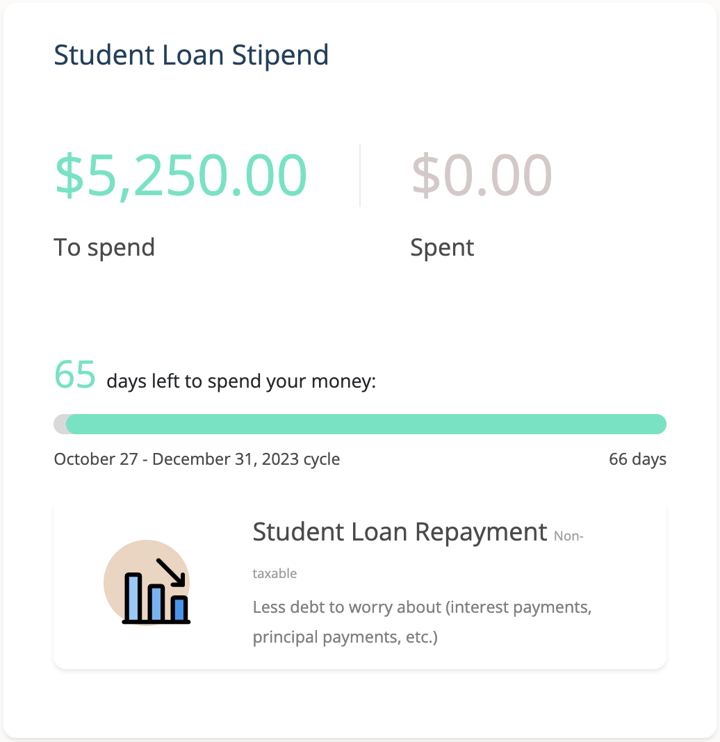

A student loan repayment program is a benefit employers offer to help employees with their student loan debt. It is tax-free up to a certain limit and works by providing employees with a stipend that goes directly into their student loan account to help pay down the balance.

The company provides this assistance in a few different ways:

- Lump sum payment: A one-time payment to an employee’s student loan servicer or lender, commonly delivered as a signing bonus for a new hire or a single annual deposit.

- Recurring payments: Monthly payments to the employee's student loans, usually a fixed amount or a percentage of the employee's salary.

- Service-based assistance: Members of the military who take student loans qualify for loan repayment assistance through a government agency after their service or meet the requirements.

- Retirement-based assistance: Employer-matched contributions to an employee's retirement savings account if they put a percentage of their paycheck toward student loan payments instead of their retirement account (more on that here).

- Trade for unused vacation time: Employees use their earned vacation days for student loan payments instead of taking the time off.

Employers may offer repayment assistance in the form of an employer match on the principal and interest of loans. Some also cap how much their employees can receive in student loan repayment assistance.

For instance, they could match 50% of an employee's principal and interest payments, up to $10,000. Then, the amount would have to be adjusted if the total payment exceeds that limit.

Tax Implications of Student Loan Repayment Programs

Internal Revenue Code Section 127—which governs employer-provided educational assistance—states a company can provide up to $5,250 in educational assistance per year for each employee without any tax consequences for the employee. But this didn't include student loans.

Student loan repayments have historically been subject to payroll taxes. When Congress passed the 2020 CARES Act in response to the frenzy the pandemic caused, employers could exclude up to $5,250 in student loan repayment benefits from employees’ taxable income for tax years 2020 and 2021. The Consolidated Appropriations Act extended this tax break until December 31, 2025.

It's important to note that $5,250 is the combined limit for this tax-free benefit and all other tuition assistance programs. Suppose you have an intern you agree to reimburse for a $2,500 college course they need to graduate in the spring semester. If you offer them a full-time role come May, you can only provide up to $2,750 in student loan repayment assistance and still qualify for tax-free status.

Why offer a student loan repayment employer benefit?

To understand the true value of employer student loan repayment, put yourself in your employees' shoes.

The overwhelming majority (75%) of new jobs insist on a Bachelor's degree. Although this trend is slowly changing, existentially threatened high school graduates must quickly weigh the cost of a college degree against their future earning potential.

Since most high schoolers (except beneficiaries of 529 plans!) don't have $100,000 sitting around, they—with their limited experience working with lending institutions—take out loans to cover some or all of the behemoth cost of college tuition. For many students, federal aid like the Pell Grant can help alleviate some of these costs, but often it's not enough.

The light at the end of the tunnel?

Hopefully, you don't throw out their job application.

A loan repayment program is a win-win.

We say loan repayment is one of the best employee perks because it helps your employees pay down their loan balance, save money, and achieve economic security while optimizing your HR operations and boosting your bottom line.

Offering employees a student loan repayment benefit shows you value your employees and understand the burden of their debt. It also attracts college-educated talent to your organization and helps you retain employees who may otherwise leave for a company that either pays them more or does offer this benefit.

From a business standpoint, a benefit like this slashes your recruitment costs. According to new benchmarking data from the Society for Human Resource Management (SHRM), organizations now spend roughly $4,700 per new hire. Accounting for all hidden costs (e.g., lost productivity, reallocated resources, etc.), some firms spend as much as three to four times the employee's salary.

Believe us when we tell you... It's better to give your job candidates a no-brainer.

How popular are student loan repayment programs?

Since student loan repayment is now tax-free, a lot more companies choose to offer it.

Just 8% of companies offered it in 2019 before the CARES Act. That figure doubled in 2021 after its tax implications changed and companies had a few months to implement it.

Now, Fidelity, Google, Hulu, NVIDIA, SoFi, and several other forward-thinking corporations are leading the way in student loan repayment.

If loan repayment assistance programs continue to be tax-free, it's reasonable to assume that the number of employers offering this benefit will only increase. Chances are, eventually, it'll become an industry standard.

Note on the SAVE Plan for Student Loan Repayment

The Biden administration recently unveiled the SAVE Plan, an Income-Driven Repayment (IDR) option that customizes employees' monthly loan payments based on their income and family size. Unlike other IDR plans, the SAVE Plan significantly reduces payments for most individuals by calculating payments using a smaller portion of their adjusted gross income (AGI). One of its key advantages is the interest benefit it offers: if an employee's full monthly payment doesn't cover the accrued interest, the government steps in to cover the remaining interest for that month. This feature prevents employees' loan balances from growing due to unpaid interest, providing them with financial stability. Additionally, there are upcoming enhancements to the SAVE Plan in the summer of 2024, promising even further reduced payments, particularly benefiting employees with undergraduate loans.

5 Steps to Implement Student Loan Repayment Benefits

Student loan payment programs are straightforward, but setting one up can be tricky. To help you design an effective and attractive loan repayment program that fits your business, here are five tips to keep in mind.

1. Determine your payment method.

Before doing anything, you need to figure out how you plan to make payments to your employees' student loan accounts. As mentioned above, you can either pay in a lump sum or monthly.

Generally, a lump sum is better when you're dealing with highly compensated employees in managerial or exec roles — for instance, a new VP Sales who just finished their MBA but took out a loan for a few classes.

Monthly payments work better when you're trying to retain talent or scale your student loan repayment program across the whole company. Most organizations start off between $50 and $100 per employee, which seems nominal but makes a huge difference to employees over time. Consider student loan stipends to efficiently administer this benefit.

2. Set eligibility terms for your program.

Once you figure out how you'll pay, include a clause in the program's Terms and Conditions that governs eligibility for loan repayment assistance. Determine who qualifies and what criteria they need to meet to qualify (e.g., full-time employment status).

Keep nondiscrimination laws in mind when making eligibility decisions. Ensure your criteria don't discriminate against any protected classes like age, gender, religion, or national origin.

3. Set a cap on your maximum contribution.

Just like you would for a 401(k) plan, decide the maximum amount you'll pay per employee and make sure it's included in the program's Terms and Conditions.

It's best to keep your maximum contribution slightly below the $5,250-per-year limit mentioned above to ensure your employees don't accidentally have to pay any taxes on their benefits.

4. Decide whether you want to tie a commitment to loan repayment.

Some companies have contingencies requiring employees to commit to a set amount of time with the organization to qualify for student loan repayment benefits. This prevents employees from taking the benefit and leaving after you pay it.

For instance: "We will pay up to $2,000 toward your student loan debt in the form of a lump sum provided you remain employed with the company for one year."

5. Notify employees and promote the program.

Once you have your policies in place, it's time to let your staff know about the benefit and how they can take advantage of it.

Set Up Your Student Loan Repayment Program With Compt

There are two ways to do things: the hard way and the easy way.

- The hard way: Take the DIY route, set up your own program, figure out how to navigate the compliance and paperwork, and guess how much you've put toward your employees' student loan payments this year. Have you hit the $5,250 mark yet? We don't know.

- The easy way: Use Compt to set up your student loan repayment program in minutes, get expert guidance on compliance and paperwork issues, and manage all your employee perks in one place.

With Compt, employers can create a recurring student loan stipend employees can use for student loan payments. It's that easy, and it's 100% tax-compliant.

Click here and we'll show you.