A student loan stipend is an employer-provided cash payment that helps employees pay off their student loans.

Last updated by Sarah Bedrick

45 million Americans have federal student debt, and more than half of today's college students will graduate with loans to pay off.

For many, it's a necessary evil. They use the money to pay expensive tuition fees, which land them a degree they can use to land a job at a company like yours. But, this leaves many of them with a significant financial burden after graduation.

Including student loan stipends in your benefits package is an easy and low-cost way to support those who worked hard to earn their degree and chose your company as their employer.

In this guide, we'll cover...

First, a brief definition:

A student loan stipend is an employer-provided cash payment that helps employees pay off their student loans.

These funds are typically paid out on a recurring (monthly) basis or as a lump sum (annually). You can choose to offer a fixed amount or match your employee's payments up to a certain limit. Like other perk stipends, you can also standardize the payment amount across your organization or vary it from one employee to the next.

Employers typically offer student loan stipends to...

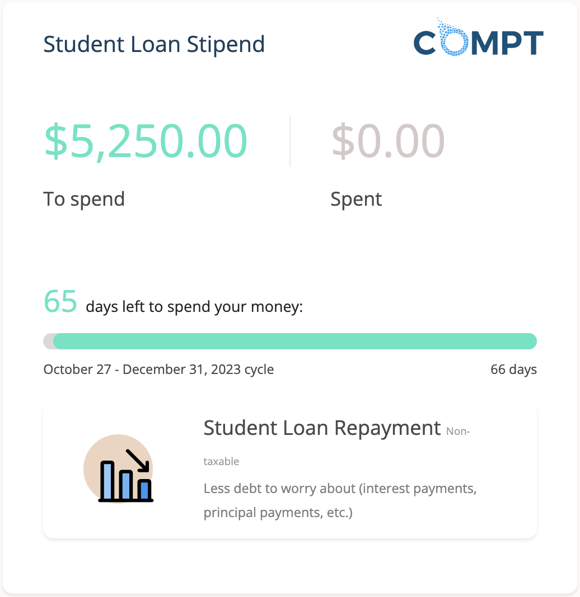

Student loan stipends are a pre-tax benefit, up to $5,250 per employee per year. This is bundled with any other student loan assistance you may provide, such as tuition reimbursement and loan consolidation programs. You cannot offer $5,250 in addition to other assistance options (more on all this later).

Using stipend software is far and away the easiest way to help your employees with their financial aid funds.

The 3-step process is simple:

You can choose to supplement the employee's payment by a fixed percentage or amount. Or, you can simply match their existing payments. Since they're so easy to set up, you can build them into your existing educational assistance program or offer them as a standalone employee perk.

Student loan stipends are a specific form of student loan repayment assistance. Your program might also include direct payments to a loan servicer for the following three sources:

Stipends and reimbursements are two related benefits that help employees pay for their education. While both are advantageous to your workforce, they're different beasts.

Tuition reimbursements:

Student loan stipends:

College costs an astronomical amount unfathomable to the 30-, 40-, and 50-somethings in charge of today's companies. According to the most recent data from The College Board, the average cost of tuition and fees at a public 4-year university in 2021-2022 was $10,740 (in-state) and $27,560 (out-of-state). With those numbers, the typical 4-year degree costs $42,960 for in-state attendees or $110,240 for out-of-state ones.

These numbers don't factor in living expenses (which are even higher for students required to live on-campus). The average cost of room and board currently sits at $12,111 per year, which, if you're in-state, is more than the cost of the education itself.

Between classes and living expenses, student loans are the only option for anyone without tens of thousands in their bank account (or a relative who does).

If the numbers aren't convincing enough, here's a holistic look at why many top companies offer student loan stipends:

If you're wondering, "How many people actually take out student loan funds?!" the answer is, "A lot. At least 1 in 2." Of the 54% who graduate with debt, they're looking at $29,100.

A survey by YuLife and YouGov revealed that 80% of US-based workers say financial stress negatively affects their performance. Enhancing employees' financial well-being boosts your workplace's appeal. 66% of US working adults consider a company's support for their financial well-being when applying for a job there.

In addition to attracting the best talent, student loan stipends also help you retain current ones. Money isn't the only reason people change jobs, but it's the most important deciding factor for those looking at a mountain of debt.

Employers who offer student loan assistance gain a unique advantage in the war for talent; it's an easy way to set yourself apart from competitors and build a loyal, satisfied workforce. Investing in your employees' education also has intangible benefits like increased employee morale, engagement, and productivity.

Help your employees tackle student loan debt and promote the financial wellness of your workforce.

Thanks to the 2020 CARES Act (and Consolidated Appropriations Act extension), offering student loan stipends is a no-brainer. Now, almost 1 in 5 employers offer repayment assistance. An additional 31% say they plan to by the end of 2023.

Here's a look at how some well-known employers help their employees with their debt:

On the surface, taxes, percentages, and confusing terminology are a lot to take in. But offering a student loan stipend is simple.

The two main ways you'll pay out your stipend are annual lump sum and recurring monthly payments.

Most organizations begin by offering $50 to $100 per month per employee. This might seem small, but as we saw earlier, it can make a huge impact on employees' financial well-being.

You'll want to include a clause in the Terms and Conditions governing your stipend program that outlines the eligibility criteria.

The nice thing about stipends vs. other forms of financial assistance is your employees take care of the payment. You don't have to worry about private lenders or their school's financial aid office. So, you can maximize eligibility without creating a massive back-office headache.

Some companies pay as much as they can while still receiving the tax break for doing so. Others don't have the budget for $5,000+/year, so they offer a smaller amount. Some employers even match the employee's contribution, up to a certain maximum limit. With a stipend, you have flexibility here.

No matter what you do, it's best to keep your max amount below the $5,250 threshold. Otherwise, you could wind up paying taxes on accidental overages.

Maximize employee enrollment by announcing your new program with a company-wide email, on your website, and in all-hands meetings.

For your future employees, make sure hiring managers know to include information about this benefit during the interview and job offer process.

Using Compt, it's really easy to get these stipends out via payroll. We'll integrate with your payroll and accounting tools, which makes the entire process nearly automatic. Since you can set eligibility guidelines ahead of time, you can onboard new employees without additional hoops to jump through.

Help your employees tackle student loan debt and promote the financial wellness of your workforce.