As the market for skilled labor tightens, the ways in which employers support their employees have grown in tandem.

Because of the expansion and increased investment in total compensation packages, now more than ever, the industry needs clear definitions of what benefits, perks, perk stipends, and lifestyle spending accounts (LSA) are. Continuing without a consensus, people will continue to be confused, time and money will continue to be wasted, and worst of all -- we won’t understand our employee's actual needs.

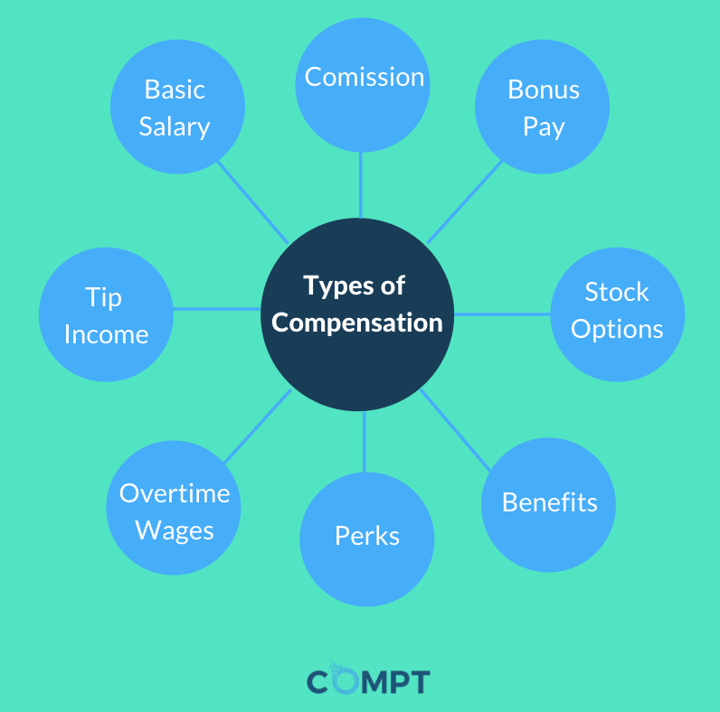

Below are the elements of compensation we'll cover in this piece:

Compensation Definition:

While once considered just salary, the definition of compensation has expanded to describe the entire package that employees receive for their labor.

Compensation includes salary, bonus commission, stock options, benefits, perks, and any other additional financial or non-financial extras.

According to an Ernst & Young report, 63% of respondents said that an employer which “provides fair compensation and good benefits” was a leading factor in determining the level of trust to place on their employer.

Sources: Small Business Chron, The Balance Careers

The monetary amount to which your employer agreed to pay you for your employment. Salary is often referred to as base pay as it does not include any of the additional benefits, perks, raises, or promotions.

Salaries are paid to employees often on a semi-annual basis, either on the first or the 15th of every month or every two weeks.

They differ from hourly employees because pay remains unchanged from one pay period to the next, regardless of the number of hours an employee may work. Where an hourly employee is paid for the hours they work. Salaries are given to full-time employees and can be also offered to part-time employees. However, according to Salary.com, while part-time salaries are typically based on full-time salaries divided by the number of hours worked, some companies pay part-time employees a discounted rate, that is, less than the equivalent full-time salary.

Sources: The Balance Careers, Small Business Chron, Compt’s HR Glossary, & Salary.com, Investopedia

Benefits are non-salary compensation given to employees.

There are two forms:

1. Government-mandated benefits and company-determined benefits.

2. Benefits that employers are required by federal or state law to provide (within specific parameters):

Below are examples of benefits a company can offer to make their organization a more attractive place to work. They often include insurance, retirement benefits, health-related accounts, and formalized paid time off.

Sources: The Balance Careers, HR Zone benefits definition.

Perks are additional ways to support the needs of employees beyond salary or benefits and include ones that are purchasable and programmatic.

(Read here to find all the secrets you need to know to build a top-notch perks program)

Purchasable perks include catered lunches, books, fitness stipends, pet insurance, and student loan forgiveness. Programmatic perks are policy-driven advantages to working at a company such as being pet-friendly, Summer Fridays, or remote work.

Perks are one of the largest umbrellas of offerings as many items fit within them.

To see a comprehensive list, check out this employee perks listing page.

Sources: JustWorks, Compt Employee Perks, Robert Half

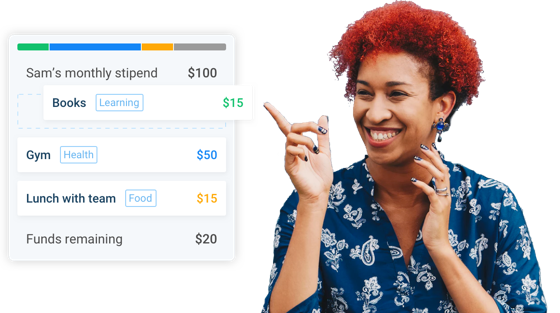

Perk stipends are monetary amounts allocated to employees for them to spend on perks that align with specific company policies, values, or culture initiatives. The amounts can be given to employees on credit cards, paid back through reimbursement (while accounting for taxes), or through a lifestyle spending account.

In the example to the left, Sam's company has allocated $100 per month to spend in the following categories: learning, health & wellness, and food.

This month, Sam purchased books and a gym membership, paid for lunch with her team, and still has $20 remaining.

A lifestyle spending account is an employer-contributed account set up for employees so that they are able to purchase the perks which are most meaningful to them and their needs.

To set up a lifestyle spending account, companies set basic parameters for their employees’ lifestyle spending accounts including how much each employee can spend, within what timeframe, in which categories, and who pays the taxes. Companies often align the categories of spending with the mission, vision, values, culture, or company goals.

Lifestyle spending accounts are an ideal option for companies that wish to personalize their employee perks, support satellite offices or remote employees, ensure IRS tax compliance with perks, and remove the administrative burden on HR for managing individual perks and vendors.

This sounds perfect, doesn't it? Want to learn more about how LSAs work? Read all you need to know about them here.

Sources: HR Daily Advisor, Lifestyle Spending Account eBook.

We have a helpful resource for you. Download our Ultimate Guide eBook and receive 22 pages full of what you need to know.

It's FREE!