An out-of-state care stipend is a set amount of money an employer offers its employees who need to undergo medical procedures outside their home state or network.

Disclaimer: Compt does not provide tax or legal advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Most health insurance benefits will only cover certain medical procedures in your home state or within a specific network of providers. But what if an employee needs to undergo a medical procedure or obtain treatment outside those boundaries?

An estimated 112 million American adults (or, nearly half the adult population) struggle to pay medical bills. Without insurance coverage, the cost of an out-of-state or network procedure can easily break their bank.

That's where out-of-state care stipends come in. They're fantastic for employers who want to offer additional support and peace of mind to employees who may need specialized medical care outside their state.

In this comprehensive guide, we'll cover:

First, let's define it:

An out-of-state care stipend is a set amount of money an employer offers its employees who need to undergo medical procedures outside their home state or network.

For example, if an employee needs to travel from Texas (where their insurance plan is based) to California for a medical procedure, this amount would help cover their expenses.

There are plenty of reasons someone might need to undergo a medical procedure outside their state or network.

Out-of-state care stipends improve your employees' access to healthcare. They're typically made available as an annual lump sum to those who qualify.

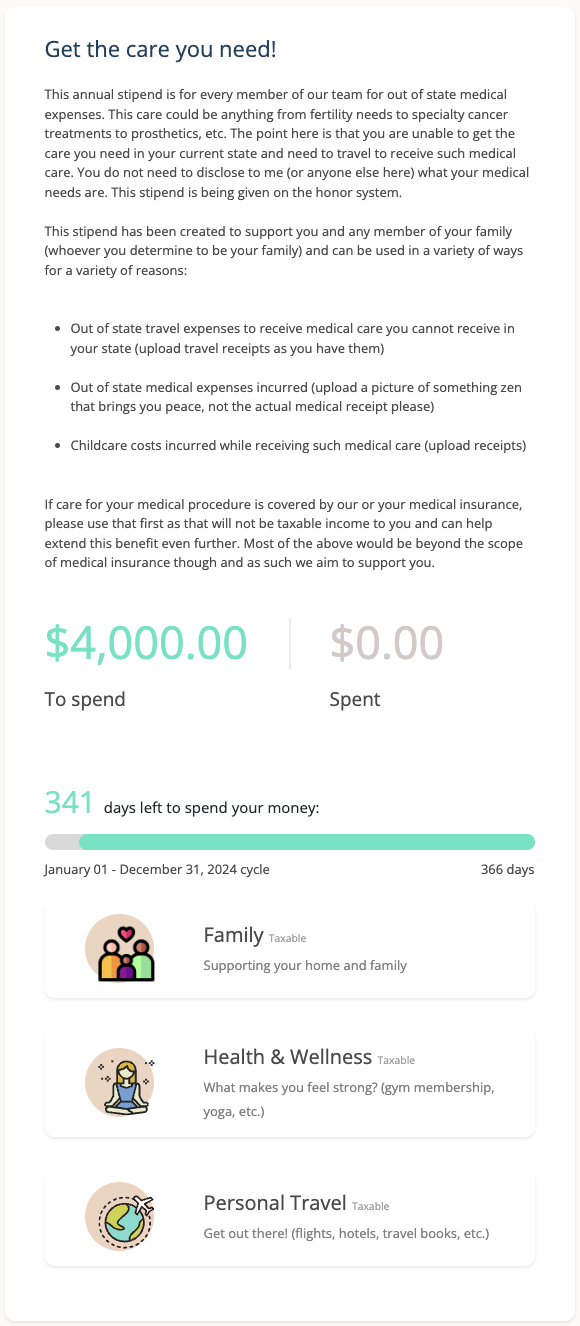

At Compt, here's what the out-of-state care stipend we offer looks like:

Your employees might need out-of-state treatment for any number of reasons. Reproductive care, specialty cancer treatments, mental health care, addiction programs, and prosthetics are among the most common.

Basically, employees put the stipend toward three types of costs:

Out-of-state care stipends can range from a few hundred to a few thousand dollars, depending on the company.

Out-of-state care assistance is an inclusive employee benefit that shows your company cares about its staff's health and well-being.

Specifically, it:

While employees in your New York or San Francisco offices might have access to top-notch healthcare, residents of states like West Virginia, Arkansas, and Louisiana have considerably fewer options.

It's a financial wellness issue, too. 57% of Americans can't afford a $1,000 emergency expense. And, in a 2023 PwC survey, nearly 60% of employees noted finances as the number-one cause of stress in their lives. Taking measures to reduce their financial stress will show improvements in productivity, job satisfaction, and, ultimately, loyalty.

There's an important distinction between healthcare stipends and health insurance benefits: stipends are not health insurance. And they aren't a substitute for it, either.

An out-of-state care stipend is a specific type of healthcare stipend — it’s designated for this type of health care only and has a broader application. It's a fixed, taxable amount you can reimburse to employees through payroll.

It can’t be used exclusively for health insurance premiums. Instead, it's intended to reduce or eliminate medical and related expenses insurance plans don't usually cover.

Healthcare benefits are more comprehensive. They take the form of subsidized or fully paid-for health insurance premiums or an HSA (health savings account). They're non-taxable, meaning they aren't subject to federal income tax withholding, nor are they subject to Social Security, Medicare, or FUTA tax.

Unlike stipends, you'll pay insurance benefits directly to the organization that provides your employees' health insurance plans. Their purpose isn't solely for out-of-state care; instead, they're intended to cover a range of medical costs, including primary care visits, prescription medication, and emergency services.

Health insurance companies operate within the legal frameworks of the state where the employee is located, and as a result, coverage for certain procedures may be limited. If you’re already offering employees health insurance, an out-of-state care stipend can make this benefit truly comprehensive.

From a legal, regulatory, and tax compliance standpoint, there are a few risks you should be aware of when offering out-of-state care stipends.

The one area that gets tricky is when your employees' medical needs are related to birth control or abortion travel.

State laws regarding abortion care are constantly changing. While some states' laws protect employers from liability, Texas and Oklahoma, for example, allow private citizens to sue any person or company for "aiding or abetting" patients in obtaining an abortion.

If you are in a state where employees can’t obtain care, your organization could face potential risks. It’s important to consult with legal professionals to manage these risks strategically.

The IRS refers to any benefit you offer your employees that aren’t part of their regular pay as “fringe benefits.” Out-of-state care stipends are one such fringe benefit, and they’re taxable.

This means you'll need to report them as part of your employees’ wages in their W2 forms.

Unlike other employee benefits, it’s best to keep restrictions to a minimum for the out-of-state care benefit. This minimizes your liability exposure as an employer. Here are some best practices to reduce your risk:

To offer this stipend to your employees, follow the steps outlined below:

The first thing you'll want to do is determine how much this benefit will be worth. Since medical expenses and associated costs vary wildly, it's best to set a cap on how much you'll offer as a benefit each year. Depending on your resources, this could be anywhere from a few hundred to a few thousand dollars.

Keep in mind when budgeting that most employees won't ever need to use this stipend. You want the amount to be enough to make a difference for the individuals who do need it.

There are four main considerations, as far as stipend design is concerned.

Documentation: At Compt, we require employees to submit receipts for everything associated with their travel, such as plane tickets and meals (but not for the care itself).

Compt makes it easy to administer any kind of customized stipend program. You can easily:

Never seen it? Schedule a demo now!

With employee stipend software, all you need to do is assign the one-time or recurring stipend to eligible employees.

Then, communicate this benefit to employees so they know exactly how much is offered and what the parameters are.

Interested in learning more? Request a demo to see how Compt can help you administer an out-of-state care stipend as well as other personalized employee benefits.

A stipend makes it possible for companies to offer lifestyle benefits, with less money and ensure that they are personalized to meet the needs of their people.

Are you ready to set up an out-of-state care stipend?

Our experts can help you create a program that makes healthcare truly comprehensive for your employees.