Financially secure employees are happier and more productive. But most are burdened by debt, elder care, or other financial concerns that impact their work life.

They've historically looked to employers for financial and retirement planning through employer-provided 401(k) plans, pensions, stock options, and life insurance.

Employee financial wellness programs give today's employees the holistic support they need to succeed at work and at home.

What is an employee financial wellness program?

Spending. Saving. Borrowing. Planning. These four areas affect your employees' ability to weather the storm against financial challenges.

A financial wellness program is an employee assistance program that helps workers achieve financial well-being. It comprises educational resources like budgeting and financial planning tools, as well as access to debt management services, credit-building services, wage advances, and financial counseling.

The goal of a financial wellness program is simple: go above and beyond to ensure money-related stress isn't an overbearing factor in employees' lives.

Why is financial wellness important for employees?

It goes without saying that your employees work for the paycheck. What is worth saying is a paycheck isn't enough to help employees achieve financial security.

(Source)

According to a new PwC survey, financial stress remains the top concern for most US workers, more so than work, family life, and personal health. Considering more than half of employees making over $100,000 live paycheck to paycheck, this isn't just a problem that impacts low-income earners (though it does disproportionately affect them).

In one way or another, most of your employees are burdened by looming financial issues, and it's affecting their well-being.

Financial health affects more than just commas and dollar signs.

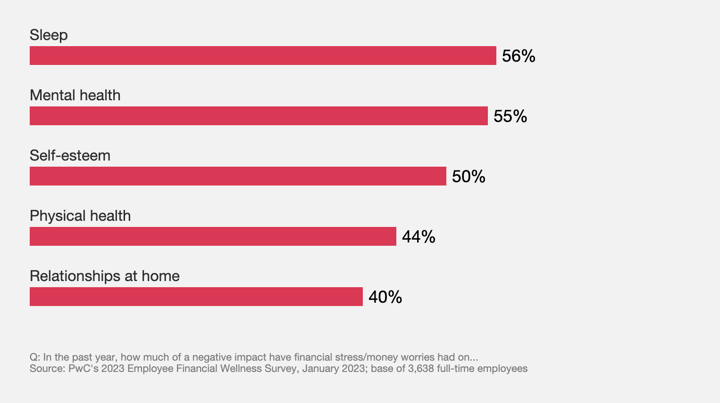

(Source)

According to the abovementioned PwC Employee Financial Wellness survey, financial worries have had a negative impact on sleep, mental health, self-esteem, physical health, and relationships.

40% of employees plan to push back retirement.

Nearly half of those 45 and older are pushing back retirement due to inflation, according to October 2022 research published by the Nationwide Retirement Institute.

To businesses, the cost of delayed retirement is huge. Even a one-year delay in retirement results in additional yearly workforce costs of around 1% to 1.5% and an incremental cost of more than $50,000 for each employee whose retirement is delayed.

The aging workforce pushing back their retirement is a problem unraveling in real-time, but younger employees are affected. The survey found fewer than 60% of all employees have a positive outlook regarding their retirement plans.

Some of your employees can't even cover a $1,000 emergency expense.

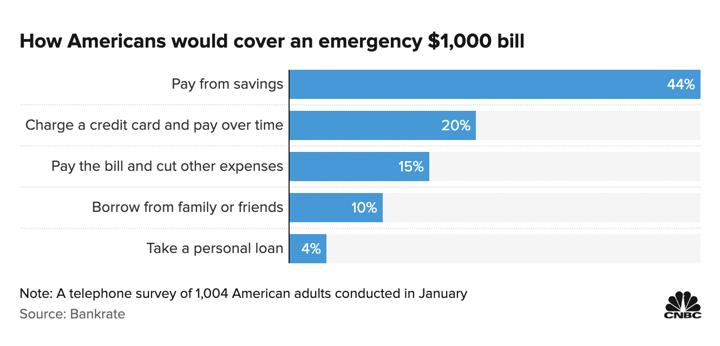

According to a Bankrate survey, more than half of Americans can't cover a $1,000 emergency expense with savings. Rather, they'd go into debt (or, in many cases, more debt) to pay for it.

(Source)

It's worth noting that the data skews slightly the other way for college-educated employees and those earning over $50,000, but only slightly. And many of those employees are burdened by student loan debt instead.

Two in three employees struggle at work because of it.

According to a 2023 study from Morgan Stanley, two-thirds of employees say their finances negatively impacted both their home life and work performance.

And it's easy to see why — less sleep, relationship stress, and a decline in self-esteem all add up to lower productivity.

The challenge is only growing.

Since 2021, there has been an 11% increase in employee financial stress, according to BrightPlan's 2022 Wellness Barometer Survey.

Employees who dealt with financial worries lost an average of 11.4 hours of productivity each week, a figure amounting to over $4 billion in lost weekly productivity for U.S. employers.

So, how can you keep this from impacting your business?

By giving employees what they want.

Between student loan repayment, credit card balances, medical bills, family care, and the inability to put much (if any) aside, it's no surprise that a financial wellness package is the number one requested employee benefit.

According to the survey, employees say they would work harder, feel more financially secure, stay with their companies longer, and feel more motivated and productive.

How to Support Employees With a Financial Wellness Program

Unfortunately, we can't fix the rising cost of living. But we, as employers, have a responsibility to ensure our employees are well-supported.

Here's a step-by-step guide:

1. Understand your employees and their financial lives.

Before talking to your employees and creating an employee benefits package, it's your responsibility as a leader to understand your employees' financial realities.

For that, you'll need to look at the data you already have and examine a few key financial wellness indicators.

Take-Home Pay

At the end of the day, how much do your employees earn? And how does it compare to where they live?

Starting with salaries and wages across different organizational roles is the best way to understand your employees' financial wellness.

When PayPal surveyed their employees to understand their financial situations, they realized six in 10 of their hourly workforce and call center employees struggled to meet their basic needs.

Using a living wage calculator (like MIT's) can help you understand how much your employees need to make to cover the basic costs of living, which will give you a baseline understanding of how far their take-home pay really goes.

Your Current Benefits Package

Take-home wages and salaries are just one part of total comp — you need to understand how your benefits (or lack thereof) could be affecting your workforce.

- How many are eligible for healthcare, 401(k)s, and other benefits? And how much do those benefits cost them?

- What proportion of your workforce is enrolled in these benefits, and does it vary across earnings levels?

- How much do employees spend on company-sponsored health insurance, and what percentage of their income is tucked away to pay for it?

If you have low participation rates in your health insurance and employer benefits programs, it's highly likely they're too expensive for many of your employees.

Retirement Plans

Your company's 401(k) or 403(b) plans can tell you a lot about your employees and where they might experience hardship.

To withdraw from retirement savings, they have to prove to your plan admin that they have had a significant financial problem (e.g., large medical bills, eviction or foreclosure notice, etc.). If several employees are tapping into their retirement funds, it could signal a bigger problem with companywide financial wellness.

Some employees will also take out loans on their retirement savings. Though they don't need to "prove" anything to take a loan, the record of this still underscores the realities of their financial lives.

Other Financial Security Indicators

Aside from retirement plans and benefits enrollment, there are a few other areas your employees might show signs of financial difficulty.

Looking at your employee data, see if you can find any of the following:

- A significant number of employees requesting advance payments

- Few employees using direct deposit

- Low retirement plan enrollment rates across multiple demographics and organizational roles

- Absenteeism or low productivity (which could be due to financial stress)

- An increase in turnover (which could suggest employees are seeking better pay elsewhere)

2. Figure out what your employees need from a financial wellness program.

According to BrightPlan's survey, the things most employees want out of a financial wellness program are investing tools (88%), financial education (87%), and consulting for personal finances (84%). But you need to survey your own employees if you want such a program to actually work.

Tons of factors could impact your employees' outlook on what's important. Your entry-level new hires fresh out of uni probably care more about their student debt than retirement savings, while your middle-aged employees are preparing to have kids, buy homes, and stash money away.

On the bright side, knowing how your employees feel is easy. All you have to do is ask.

The best way to ask is through a confidential employee benefits survey, which you can focus around finances. That way, they'll have a safe space to share what's on their minds, and you'll have accurate feedback about their wants and needs.

A few things to target:

- Their current day-to-day stress levels in and outside of work

- Whether or not they've struggled financially in the last 12 months

- How many times they've felt stressed about their finances in that same time frame

- If they have any kind of debt (and what kind)

- Whether or not they're able to save any money from their paycheck

- Whether these issues have impacted job performance

- If they invest, and if they don't, why not

- How they feel about their current knowledge of personal finance

- What type of resources or tools they'd like you to provide

- What type of financial topics and education they would find useful

- Which employee assistance programs they would enroll in (counseling, debt management, consulting, etc.)

3. Design a financial wellness program that meets employees' needs.

Once you've gathered the data and understand what your workforce wants, you can create an employee benefits package designed for financial security.

Depending on the size of your company budget and the number of employees you have, tailor-made programs will vary in both comprehensiveness and scale. At the very least, your financial wellness solutions should offer support around these four specific topics: spending, saving, borrowing, and planning.

- Spending: Help employees learn how to stay within their budgets and understand the difference between needs and wants. Pay advances and financial assistance programs can have a direct impact in this area.

- Saving: Offer ways to help employees save for their goals and build an emergency fund for unexpected expenses through resources like health savings accounts and employer matching.

- Borrowing: Give qualifying employees the opportunity to pay down their debts with short-term employee loans, student loan repayment assistance, and debt counseling.

- Planning: Educate employees about savings, investments, estate planning, and long-term financial goals.

The most important thing to remember is that your financial wellness program should have flexibility for lower-income employees who might not be able to take advantage of the same resources as their higher-income counterparts.

For maximum impact, the best way to start is with employer-sponsored financial coaching and employee stipends.

4. Get buy-in from your employees.

After you have decided on your plan structure and resources, you’ll need to make sure it meets the needs you surveyed your employees on.

Communicate the elements of your financial wellness program, as well as the reasons why you are launching it. And consider running a second survey to gather feedback on prospective enrollment rates and anything else they want to see.

Leadership should consider trying out the program themselves first. That way, they'll have as much information as possible when it comes time to launch.

5. Launch your employee financial wellness program.

You've asked your employees, refined your program, and tested it yourself. Now, it's time to plan your communication and launch.

Employees should hear about the program from frontline managers first — whether it's through a weekly huddle, a quick meeting specifically for that purpose, or a memo. As much as possible, draw on real-life examples of how the program could help employees in their unique financial situations.

Financial wellness programs should also be integrated into your regular onboarding procedures through HR software and benefits enrollment. You'll have to add it to your paperwork, create an internal page on your website for it, and add the information to training sessions.

6. Monitor the performance of your financial wellness activities.

Supporting employee well-being is an ongoing initiative. You should measure the success of your program over time by looking at KPIs like:

- Employee enrollment percentages and rates

- How many times they access the resources you provide

- Program satisfaction ratings

- Employee debt levels and repayment rates over time

- Changes in financial stress levels among your workforce

You should also look for changes in employee absenteeism, retention rates, and productivity to see if there are any correlations between your financial wellness program and other areas of employee engagement.

Let Compt do the work for you.

There are tons of moving parts when it comes to employee financial wellness programs. Tax deductions and compliance, legal considerations, surveys and communications, and employee data turn your program into a mountain of numbers, equations, and confusing terminology.

In an effort to improve your employees' well-being, you'll crush that of your HR department.

With Compt, it's easy. Set up employee stipends for financial wellness initiatives that employees can choose like consulting, student loans repayment, debt management, and financial coaching.

Click here and we'll show you.