A caregiving stipend is a regular fixed amount of money caregivers receive from their employer as financial assistance and support for their caregiving responsibilities.

Published October 5, 2023 by Sarah Bedrick

Want to support working caregivers on your team? A caregiver stipend is the perfect place to start.

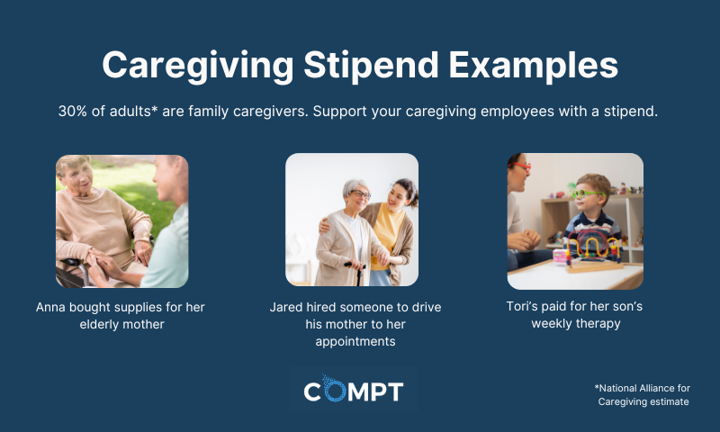

Almost 30% of the adult population or 1 in 4 millennials currently serve as family caregivers for aging parents, a spouse, a dependent, or an extended family member with an illness or disability.

In addition to their own expenses, a primary caregiver typically handles their loved one's everyday personal care and medical costs. And they do so with little to no financial support from the government.

By offering stipends to employees who care for aging relatives or children with special needs, you can better support (and retain) them. In this guide, we'll show you exactly how.

First, a brief definition:

A caregiver stipend is a regular fixed amount of money caregivers receive from their employer as financial assistance and support for their caregiving responsibilities.

A caregiver is a person who tends to the short- or long-term needs of someone unable to self-sustain due to illness, injury, or disability.

Caregiver stipends are monthly, quarterly, or annual recurring payments. The amount varies depending on the employer's policy. Some employers offer a flat-rate payment to all caregivers (or up to a certain amount), while others will cover a certain percentage of out-of-pocket expenses.

You might also refer to caregiver stipends as:

Caregiver stipends are a type of family stipend. Other stipends employers offer to support employees' family members include adoption assistance, fertility support, and child care benefits.

With Compt, you can offer a tax-compliant caregiver stipend on a recurring or one-time basis.

What does a caregiver stipend cover?

The beauty of stipends (as opposed to health insurance that covers caregiving) is their flexibility. When you offer a caregiver stipend, you give your employees the freedom to privately choose what they want or need to cover for their family members.

Employees typically use caregiver stipends for the following:

Note: If your employer-sponsored health insurance covers family caregivers, it's a good idea to check which services it covers and how much of the cost is reimbursed before offering the stipend. That will help you calculate how much you want to offer, or which expenses you plan to cover.

Employers often confuse caregiver stipends with the VA caregiver support program (also called the Program of Comprehensive Assistance for Family Caregivers).

This program is a federal health benefit sponsored by the Department of Veteran's Affairs. It's available to caregivers of service members or veterans who were injured during active duty service. It provides access to medical care, support services, counseling, and financial assistance (in the form of a monthly stipend) to those who meet the VA disability rating criteria.

VA caregiver benefits are certainly helpful for employees caring for disabled veterans (if the eligible veteran resides in their home, that is). But it's a highly specific program that benefits a small fraction of the 42.5 million Americans with disabilities.

Employer-sponsored caregiver stipends are much different. They're for anyone at your company providing care to their family members, not just veterans. And they're offered by you, so they're considered taxable income.

They may seem intimidating, but caregiver stipends are actually quite easy to implement. Using perk stipend and allowance software, it takes about 15 minutes.

You can make them part of a larger caregiver benefits program, disburse a lump sum payment each month, or offer itemized reimbursements for qualifying expenses.

Lump sum payments are the most common form of caregiver stipends. They're fixed payments you'll offer monthly to any caregiver on your team who enrolls (and meets your predetermined criteria).

These payments can be a flat amount (e.g., $300/month), or they can vary based on an employee's seniority, role, or caregiving responsibilities.

Example: Elise, Director of Marketing at Company A, is caring for her elderly father who lives with her. Her employer offers a $250/month fixed stipend, which they disburse through payroll on the first of each month.

Some employers choose to cover a designated percentage of out-of-pocket costs (up to a certain amount) for qualifying purchases — like medical supplies, personal care services, and medications — your employee makes for their family member.

Example: Joe, an engineer at Company B, cares for his son who has a disability. Joe is able to submit receipts for basic care expenses he incurs each month, and his employer reimburses up to 25% of those expenses (up to $200/month).

To really support your caregiving employees, you shouldn't stop at stipend payments. Many employers also offer access to:

By having a system in place for employees with caregiving responsibilities, you're prepared for any employee or new hire who needs that extra support.

Example: Company C offers a Caregiver Support Program that includes a $400/month lump sum stipend, four weeks of paid family care leave, and an employee assistance program (EAP) with access to counseling services.

According to a Willis Towers Watson survey, while 25% of employers report having a paid caregiver leave policy in place today, another 22% of employers are planning or considering it over the next two years.

The costs associated with caring for someone else and limited free time when balancing a 40+ hour workweek make it incredibly difficult for employees to find time for themselves.

Companies that are truly "people-focused" understand the work-family conflict many employees deal with. They offer support services and flexible working arrangements to help people juggle their responsibilities.

AT&T recently introduced caregiving leave for their management team, allowing employees to take up to 15 days of leave. If you already offer this benefit, a caregiving stipend is icing on the cake. But if you're not yet ready to implement caregiver leave, a stipend is a great alternative to help defray some of the costs employees incur as a result of their caregiving duties.

Here are some of the most essential reasons to consider offering monthly stipends to their caregivers:

One quarter of caregivers have less than $1,000 in savings, according to the Employee Benefits Research Institute's 2023 Retirement Confidence Survey. And more than half of careviging workers provide financial assistance to their family members in addition to their own expenses.

Most family caregivers end up taking additional time off or working reduced hours to cover their loved one's needs, or taking on additional hours in order to pay for them. Whether this leads to burnout or not, it certainly leads to financial insecurity.

A monthly caregiver stipend helps employees better manage their financial obligations and reduce their stress levels. It gives them the opportunity to focus more of their time and energy on providing care.

As many as 70% of family caregivers report symptoms of depression, and 23% say it's negatively affected their physical health.

Caregivers can get burnt out whether they're working or not. But when they are employed, a lack of support from their employer can exacerbate their mental and physical health problems.

An employer-sponsored stipend is more than just part of a financial wellness program. When offered in tandem with flexible working arrangements and expanded leave policies, it gives employees the time and space they need to focus on their loved ones and themselves.

With one less thing to worry about, job satisfaction, engagement, and productivity improves significantly.

Caregivers are often “unsung heroes.” They do so much for their loved ones without any recognition or acknowledgement, which can lead to feelings of isolation and loneliness.

Offering a caregiver stipend is one way employers can show their appreciation for employees' hard work. It offers financial support, but it also tells employees you're aware of the additional stress and burden they carry.

Supporting primary caregivers on your team is an investment in your people and, by extension, your business.

But you definitely want to do it right. Software makes your program easy to set up, but that doesn't mean it's a set-it-and-forget-it kind of thing. It's quite the opposite.

Follow these steps when setting up your caregiver stipend program:

Caregiver stipends are a fantastic way to incentivize employee loyalty. But the enrollment process will be a bit more rigid. And they're a bit more expensive to offer than, say, a wellness program or commuter benefits.

Common criteria companies set include:

According to an AARP study of more than 2,400 caregivers, yearly out-of-pocket expenses come out to $7,242 on average. Family caregivers typically spend 26% of their income to cover these costs.

As an employer (particularly one with a limited budget), you don't necessarily have to cover all of these expenses. You can set a cap for how much you'll reimburse your employees based on their needs and the amount you're able to offer.

Most organizations decide on a lump sum between $200 and $500 per month.

Keep in mind: Caregiving expenses are often a significant part of your employees' paychecks. It would be inappropriate to call an amount too low to make a difference (e.g., $50) a "caregiving stipend."

Your HR team will onboard caregiving employees into your program and provide them with materials explaining how it works.

These materials might include:

Your HR team will onboard caregiving employees into your program and provide them with materials explaining how it works.

These materials might include:

You can set up a single- or double-approval process for approving stipends and reimbursements. For stipends, it's even easier — Compt will disburse them automatically on the same day of each month.

Accounting software integration makes it easy to track and manage stipend payments. And payroll integration automates the payout process so you don't have to worry about manual checks or transfers.

Providing a caregiver stipend is just the tip of the iceberg. There are other ways you can support your employees mentally, physically, professionally, and financially.

With Compt's stipend reimbursement software, you can easily create, automate, and manage your caregiver stipend programs-.