In response to a tight labor market and persistent inflationary pressures, companies worldwide are changing the structure of their total compensation packages. So, in 2024, we'll see a lot more emphasis on mental health and financial wellness (among other things).

In this article, we'll break down exactly what that means for you as an employer and how you can stay ahead of the curve by creating an effective total rewards strategy.

What is a total rewards strategy?

A total rewards strategy is your company's plan for providing monetary, non-monetary, and tangible benefits to your employees in exchange for their work. It's designed to recognize employees who achieve specific business goals, like meeting a sales quota or completing a project.

Think of your total rewards package as a hybrid between total compensation and a rewards and recognition program. It's an integrated approach to employee compensation that extends beyond salary, bonuses, and benefits, with an emphasis on incentivizing achievements that reinforce your company's goals and values.

Total rewards programs help companies motivate and retain employees. They also help with talent sourcing—prospective employees are a lot likelier to consider a company with a rewards program that aligns with their goals.

What's included in a total rewards package?

WorldatWork defines five elements that comprise total rewards: compensation, benefits, well-being, recognition, and careers.

- Compensation refers to base and variable pay. In the context of your rewards strategy, it refers more to your employees' bonus and commission structure, stock options, profit sharing, and ability to qualify for a raise. It doesn't usually refer to salary (which is more standard and not usually tied to specific goals) unless a critical employee is able to negotiate it based on their achievements. But, companies should still 'reward' their employees by offering competitive salaries.

- Employee benefits are the non-wage compensations you provide employees, such as healthcare, retirement plans, and paid time off (PTO). There's a lot more to benefits programs, but the three other elements get into that.

- Employee well-being includes anything that promotes physical, mental, social, or financial wellness for employees. This can include fitness programs, employee assistance programs (EAPs), and financial planning services. It also includes work-life flexibility options like remote work or flexible schedules.

- Recognition is the way you acknowledge, reward, and celebrate your employees' achievements, whether remotely or not. You might use awards, spot bonuses, and peer-to-peer recognition to recognize your employees' work.

- Career development refers to the opportunities your employees have to grow professionally. Mentorship programs, training and development, and internal career advancement are all examples of this.

The exact type of rewards you offer will depend on your company's values, what you can afford, and, ultimately, what your employees tell you is a priority for them. A lot of times, your industry plays a role in this—companies in the pet industry offer pet care stipends, for example, even though that isn't a normal benefit in other industries.

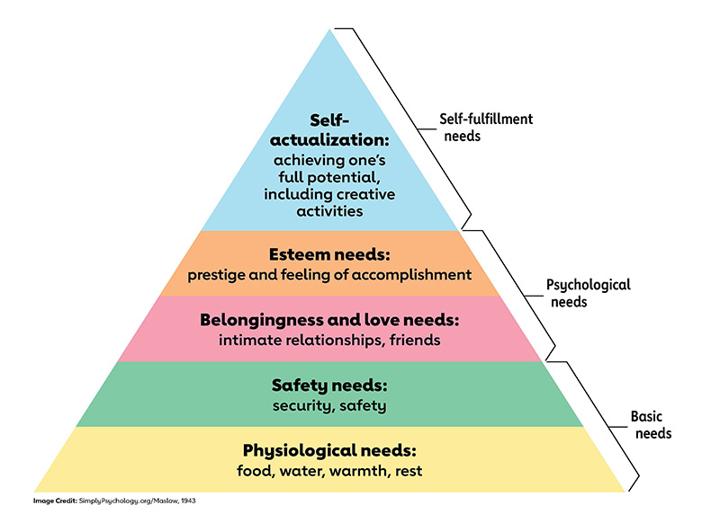

Total rewards should fit Maslow's hierarchy of needs.

A simple way to grasp the concept of a total rewards strategy is to look at Maslow's 5-level pyramid of needs — a psychological theory that suggests people are motivated to fulfill basic needs before they can focus on higher-level needs.

Incrementally, total rewards strategies support your employees at every step of Maslow's pyramid with the five elements outlined above.

- Financial compensation satisfies your employees' physiological needs. They use their take-home pay to cover expenses like food, clothing, shelter, and healthcare.

- Employee benefits support their safety and security needs. For example, when an employee has a baby, employer-sponsored health coverage and parental leave benefits can help them keep their financial security and sense of safety intact while they attend to their family.

- Employee well-being addresses the love and belonging needs each employee has. DEI programs, work-life balance support, and company-sponsored events give your workforce the opportunity to connect with one another, see your company as a safe place for them, and prioritize their personal lives.

- Recognition satisfies the esteem needs. It makes employees feel seen, respected, and valued for their contributions to your company. This, in turn, gives them motivation to continue excelling (and, ultimately, drive business performance).

- Career development opportunities have the most profound impact on fulfilling employees' self-actualization needs. When a company invests in its employees' development, they're more likely to grow professionally and achieve their full potential (in terms of professional and personal growth).

This is exactly how you structure an effective total rewards program.

In 2024, these are the most important elements of total rewards:

- Mental health. Across every industry, employees have become more candid in 2020 through 2023 about their mental health. Now, 81% of companies say they're investing more in the issue, though 1 in 3 say it's still inadequate.

- Financial wellness. Aside from the obvious stressors like rising goods and rent prices, situational employee stress like student loans, medical bills, and mortgage rates keep employees on edge about their finances. According to PwC's 2023 Employee Financial Wellness survey, 60% of full-time workers are stressed about finances. Among those making $100,00+, it's nearly half (47%).

Below, we'll break down the best ways your total rewards package can support your employees in these two critical areas.

Recognition

Insights from Quantum Workplace about the future of total rewards tell us recognition is the #1 reason employees leave their jobs. Companies with structured recognition programs showed 31% lower employee turnover, 12x higher probability of healthy business performance, and significantly higher levels of employee satisfaction.

Around 50% of professionals involved in the study said they wanted more recognition. And that's from management and their coworkers.

There are tons ways to recognize your employees:

- Manager-to-employee spot bonuses

- Peer bonuses

- Public acknowledgement in the company Slack channel

- More responsibility in their job (i.e., a promotion)

- A feature on the company LinkedIn or blog

Structuring and launching an employee recognition program is fairly simple. All you need is employee recognition software, which you can use to track bonus programs, create peer-to-peer recognition opportunities, and automatically process rewards for employees who meet specific goals.

Work-life balance

Employees are generally less stressed and more secure when they don't have mountains of personal things to take care of waiting for them while they're away at the office. So, by prioritizing work-life flexibility, you support their wellness in all four categories (mental, physical, social, and financial).

There are plenty of ways to support this:

- PTO (unlimited or at least 2 weeks)

- Remote work options (as well as a work from home allowance so employees can optimize their home office)

- Flex time (i.e., working from home Tuesdays and Thursdays)

- Paid sick days (employees don't have to worry about using their PTO or losing pay when they are genuinely ill or need to take time off for a personal emergency)

- Flexible scheduling

- Commuter benefits for employees who do have to work in person.

Remote.co's Work and Financial Wellness Report found that 63% of employees around the world would "absolutely" search for a new job if their current one stopped allowing them to work remotely. When it comes to evaluating a new job, it's the most important factor—84% say it's a consideration.

Depending on the nature of the job and what's possible for your company, you might not be able to offer fully-remote options. The point is to remove friction around your employees' ability to attend to their personal lives.

College assistance

From a financial standpoint, a college degree is a necessary evil. Your employees need one to seem attractive on the job market. But, they usually go tens of thousands of dollars in debt for it.

Although there are plenty of financial wellness benefits out there, two stand out:

These support your employees' professional development in addition to their financial well-being. And, they're tax-advantaged perks — employers to give up to $5,250 per year tax-free in education assistance benefits through 2025.

Extensive mental health resources

Aflac's 2022 Employee Well-Being and Mental Health report shows us 80% of the workforce sees mental health as equally important to (or more important than) physical health coverage. But less than half (43%) say they actually have access to such resources.

The big companies like Google and Meta can pour millions into their benefits. But even if you're a small or medium-sized business, you can still make an enormous impact on your employee wellness in the following ways:

- Choosing a health insurance plan that covers mental health services (like counseling)

- Setting up a reimbursement program for certain services

- Offering access to digital therapy, which is more affordable and accessible than traditional therapy

- Employee assistance programs (EAPs) that help employees deal with personal issues, mental struggles, and work-related stressors

- Enacting companywide mental health days

- Covering wellness app subscriptions

Offering a health and wellness stipend is the easiest way to do this. Employees can use it to cover things like counseling or app subscriptions. Or, they can use it for something different entirely, like a gym membership.

Diversity, equity, and inclusion (DEI)

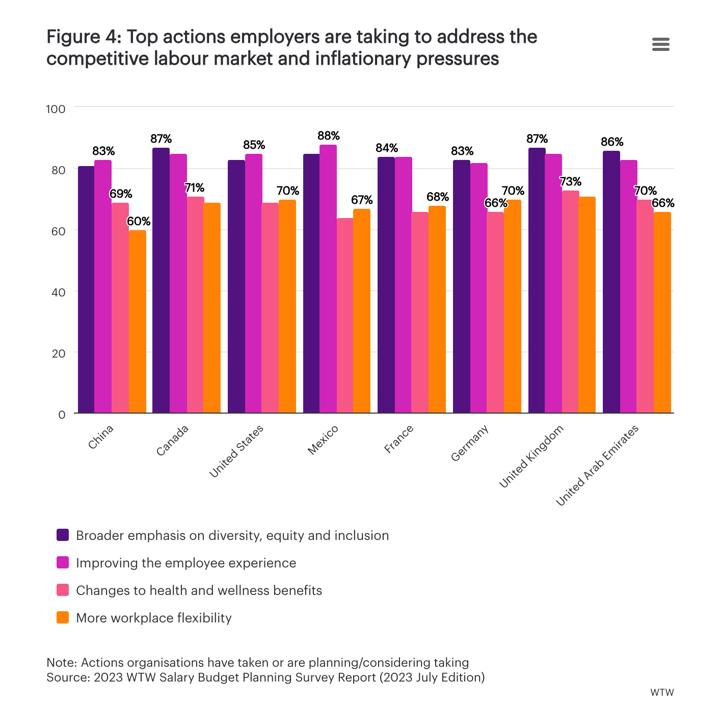

Globally, the world's top employers prioritize DEI over just about everything, notes WTW's July 2022 Salary Budget Planning Report.

Diversity is inviting someone to the party; inclusion is asking them to dance. This primarily concerns your employee experience. As far as your total rewards strategy goes, you need to offer an inclusive employee benefits package.

- Extend your benefits to contractors working 30+ hours per week.

- Find a health insurance plan that allows coverage for domestic partners to support LGBTQ+ employees and those who choose not to get married.

- Use flexible paid holidays, so employees who celebrate something other than Christmas don't have to use PTO.

- Offer parental leave, rather than maternity or paternity leave.

- Provide adoption assistance for employees who don't go the traditional route to becoming parents.

- Offer wellness programs in multiple languages and content formats.

- Set up a remote work stipend employees can use to buy ergonomic home-office furniture or anything else they need to be comfortable working from home.

These simple adjustments make your total rewards program more useful and effective for your entire workforce.

Pay equity

You might not realize it, but some parts of your total rewards program might disproportionately benefit certain groups over others.

For example, you might offer raises to those who ask in an effort to keep up with rising costs of living. Statistically, fewer women and POC ask for raises, and they do so less often.

All you have to do to fix this is:

- Establish transparent policies and procedures for raises.

- Make sure your pay bands are based on market rates, rather than arbitrary factors like tenure or prior salary.

- Conduct regular pay equity audits to ensure everyone is being paid fairly for their roles and experience levels.

When everyone (in the same role) needs to meet the same targets for a raise, promotion, or access to benefits, you eliminate the potential for subjective decision-making.

In addition to total rewards, look at your base pay.

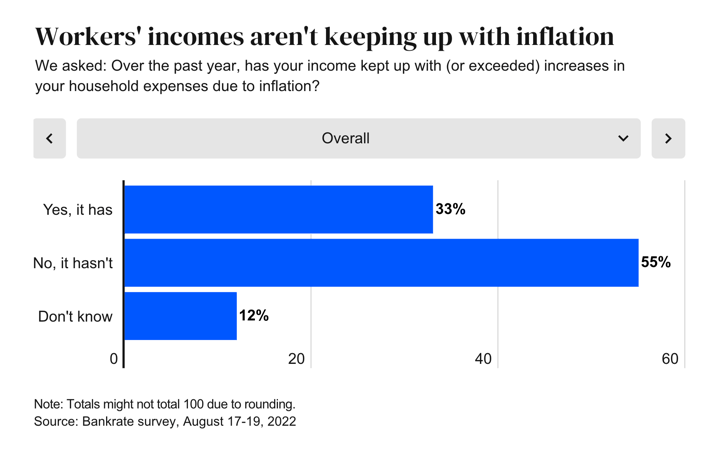

Globally, inflation and labor market pressures impact companies differently. The one constant seems to be employees are more interested in a competitive salary today than ever before.

In the US, more than half (55%) of Americans say their salary hasn't kept up with rising costs of living (even after a raise or moving to a higher paying job), according to a 2022 Bankrate survey.

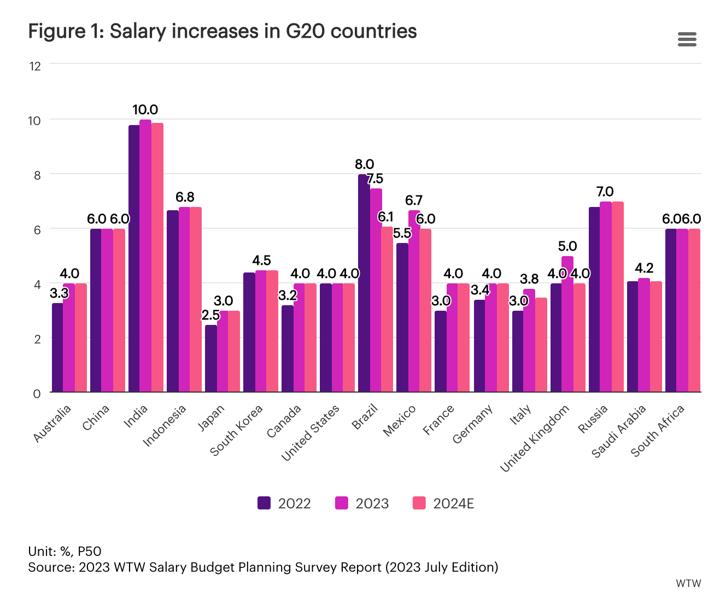

An analysis of the G20 countries conducted by Willis Towers Watson indicates that, across the world, the trend is quite similar (and will continue). Employers are expected to raise their salaries less in 2024 (though raises in 2023 were significant).

Most companies revisit the issue every year or so, but those in countries experiencing hyperinflation (like Argentina) readjust employees' salaries, on average, about 4 times throughout the year.

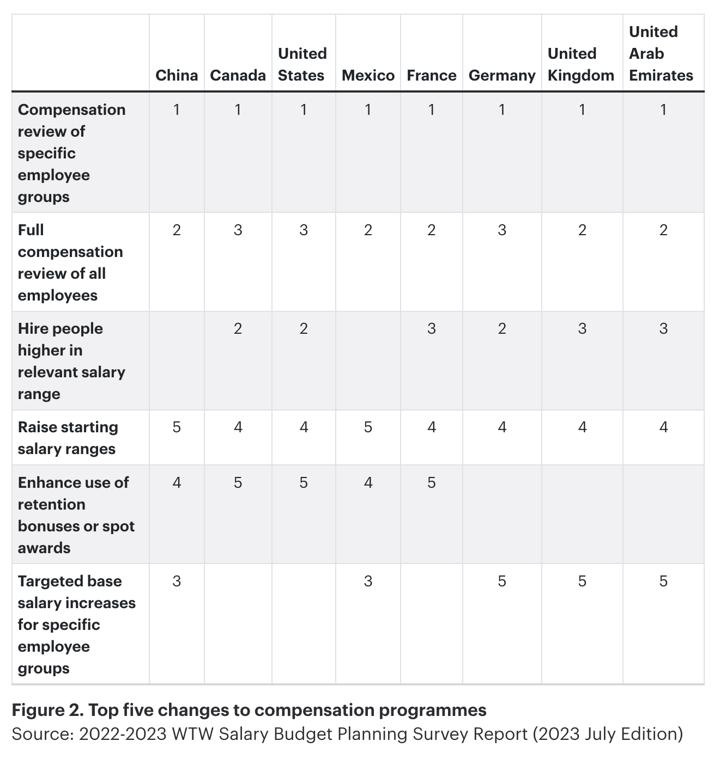

Since inflation causes employers to consider salary more frequently, it is unsurprising that a full compensation and benefits review for some or all employees takes precedence over total rewards strategy components like cash bonuses and spot awards, even among countries with much more stable economies.

While performance-based raises are the most common (and most equitable), they sometimes isolate employees who aren't working in commission-driven roles. While it's easy to structure a sales or recruitment promotion/raise structure based on revenue-based KPIs, other teams like development and accounting require a more subjective approach.

As an employer, you should consider whether or not a flat percentage raise for all employees after a certain period would be more beneficial or, if you're able to, individualized career development plans based on merit. You should also consider, based on how dramatically the cost of living changes where you hire employees, how often you'll reevaluate this critical element of total comp.

Updating and implementing your new total rewards program

With the right tools, implementing your program is quite simple. Here's a brief rundown of the steps you'll need to take:

- Gather employee feedback. Use an employee benefits survey to evaluate your current rewards package, changes in employees' priorities, and what they'd like to see more of.

- Align leadership on priorities and goals. Create a committee or team that represnets each department and level within your organization, to establish priorities, goals, and metrics for your new program.

- Translate goals into meaningful rewards programs. Using the information gathered in steps one and two, map out your program to align with what employees want while achieving organizational goals.

- Communicate the new program clearly. Educate your HR team and other leaders, so they can help your employees understand how to use their benefits, earn rewards, and more.

- Set up a system to track feedback. Employee needs and priorities are ever-changing. In addition to staying on top of trends, you'll want software that eases the burden of administering various benefits.

Compt is employee stipend software you can use to administer custom lifestyle benefits in a tax-compliant manner. Our innovative approach to rewards won us the 2024 Transform Rewards Trailblazer Award: Total Rewards Strategy of the Year.

Want to learn more? See how it works.